Corporate Governance

5 MIN READ

Management of Environmental and Social Risks

We employ a comprehensive Environment and Social Risk Management (ESRM) framework, as well as a strong three-lines-of-defence mechanism to manage these risks and to ensure adherence to our E&S risk appetite.

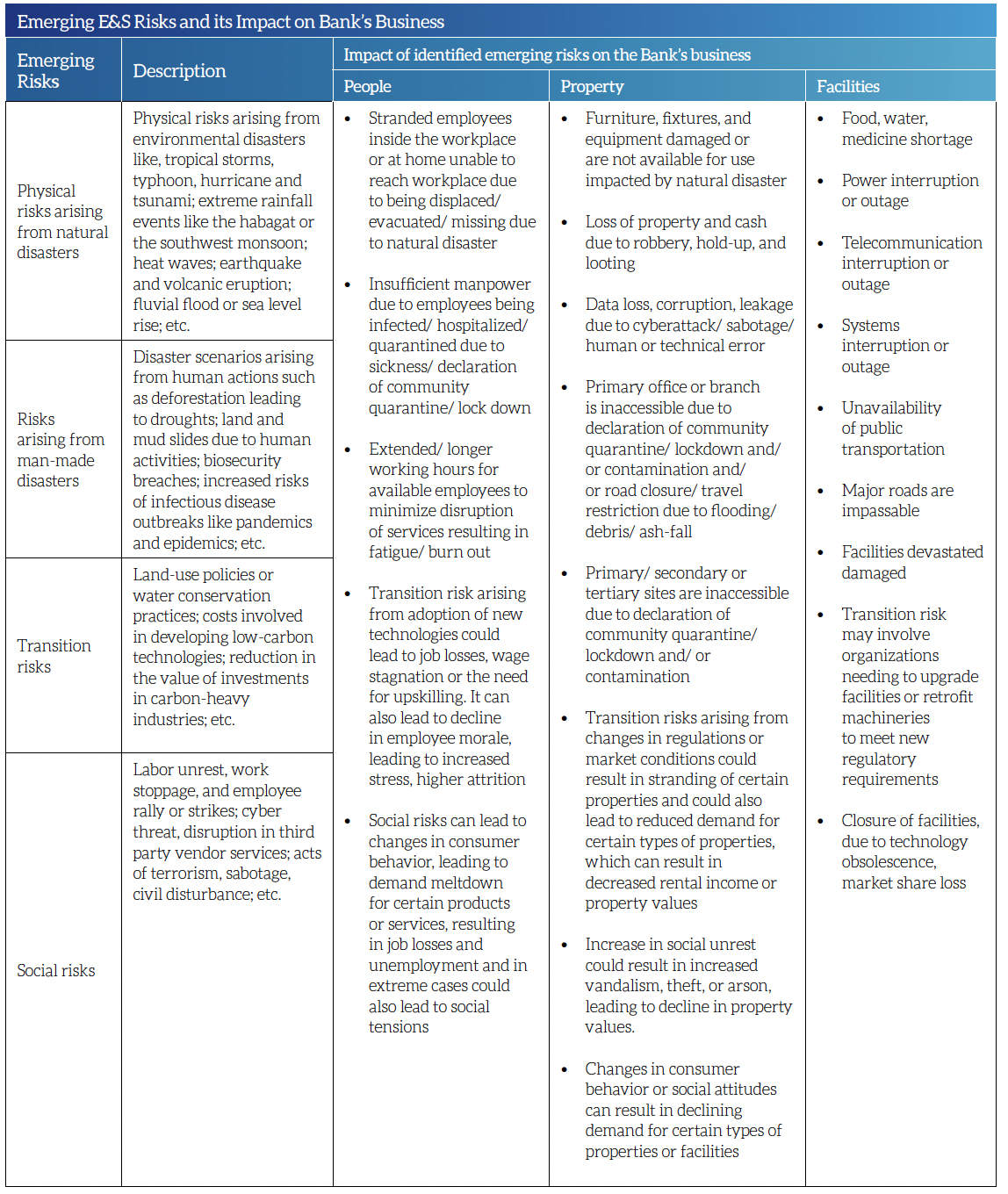

Emerging E&S Risks and its Impact on Bank’s Business

The Board oversees the ESRM, ensuring it is well integrated into the overall bank governance and our business is protected from E&S threats. The Senior Management, meanwhile, makes the ESRM work as it is intended.

E&S risks from our lending and investment activities are managed through requiring environment compliance certificates, customizing underwriting and risk management, performing stress testing, and implementing an investment policy.

E&S risks arising from products and services are managed through proper assessment during product development, among other efforts.

E&S risks are integrated in our business continuity (BC) framework by conducting awareness programs, disaster risk assessment, business impact analysis, and BC plan and exercises.

Reputational risks arising from E&S risks are addressed through our reputational risk management and crisis communication plan.