Economic Sustainability

5 MIN READ

Sustainable Finance

As one of the country’s largest banks and allocators of capital, Metrobank creates an impact that extends beyond providing meaningful banking to the markets we serve. We also play a key role in allocating finances for the functioning of the economy, mobilizing resources to support national development and the attainment of the United Nations SDGs.

Selecting Counterparties with Sustainable Business Practices

Our business could face harm from sudden financial defaults or dubious dealings with clients. Thus, we only deal with the right clients that pass our thorough credit underwriting policies. We also conduct our stringent enhanced due diligence on industries and clients that fall under our financial crime program.

Subject to enhanced due diligence and risk-based approach:

- Non-resident (foreign) customers

- Politically exposed persons (PEP) and their close family members (PEP relative), close business colleague and personal advisor (PEP close associate)

- Correspondent banks

- Arms, defense, military, extractive industries, precious metals and stones, regulated charities, non-government organizations, embassies or consulates, and payment service providers

Subject to enhanced due diligence and restricted risk-based approach:

- Non-account customers

- Non-resident customers

- Money or value-transfer services or money services business

We have identified certain types of business relationships that are prohibited by law and where there is the risk of life and well-being. We will not knowingly provide financing to businesses or operations that are directly involved in the following sectors / activities:

Atomic / nuclear power

Red light business / adult entertainment

Virtual currencies

Production and/or trading of illegal drugs

Unregulated charities

Shell banks & other shell institutions

Operations involving illegal deforestation, fishing, mining, and other similar illegal activities affecting the environment

Human rights violations (including child labor, forced labor, or human trafficking) – Metrobank will not provide financial services to companies where there is evidence that they rely on child or forced labor, or that have taken part in human rights violations or abuses.

We will align with government mandates in dealing with:

Fossil-fuel power generation or transmission, and activities dedicated to support the expansion of fossil fuel-based technologies

Sustainability Above All Else

Sustainability has become an indispensable part of corporate strategy due to investor pressure, consumer demand, and regulatory requirements. As a result, many companies are scrambling to redesign their business models to incorporate sustainable practices, but not Transnational Diversified Group (TDG).

A major player in total logistics, total ship management, travel and tourism, information and communications technology services, and other industries, TDG built its business model right from the start with sustainability at the core.

Since its inception in 1976, TDG has been committed to a greater purpose of serving society by aiding social development, creating value beyond just earning profits, and cultivating a culture of sustainability that is reflected in day-to-day operations and in investment decisions.

Today, TDG pursues multiple initiatives aligned with the United Nations Sustainable Development Goals. It has its CSR arm called NYK TDG Friendship Foundation (NTFF), in partnership with Nippon Yusen Kaisha. The NTFF is a non-stock, nonprofit organization that supports various initiatives in the areas of education, youth development, culture preservation, calamity assistance, and many more.

TDG contributes to UN SDG No. 2 (Zero Hunger) through Kai Farms, which teaches farming, seed saving, sustainability, wellness, and nutrition to vulnerable communities, public school students, and the general public. It believes that growing your own food is key to achieving food security and improved nutrition.

As a multinational enterprise, TDG meets UN SDG No. 8 (Decent Work and Economic Growth) as well. It provides meaningful employment to 23,000 individuals to improve their quality of life. Except for the expatriates assigned by joint venture partners, all of TDG’s employees are Filipinos, enabling the company to contribute to local economic growth.

In 2021, TDG launched startup company EVOxTerra through Metrobank’s help. EVOxTerra provides Filipinos with sustainable alternatives to traditional ICE cars by importing and distributing 100% electric vehicles (EVs). Since it’s TDG’s first time to finance via Letters of Credit, Metrobank guided the company throughout the entire trade financing process.

Aside from the distribution of EVs, TDG also contributes to UN SDG No. 7 (Affordable and Clean Energy) through its solar energy company, Transnational Uyeno Solar Corporation (TUSC). One of the leading solar system integrators in the Philippines, TUSC enables individuals, companies, and institutions to reduce their carbon emissions while saving costs using solar power. TDG walks the talk by using 100% renewable energy in its own office building.

TDG is currently using a technology platform to monitor its carbon emissions to ensure that it is on track to meet its goal of achieving net zero emissions operations by 2050.

Contributions to the UN Sustainable Development Goals

We provide capital to our customers so they can create wealth, thus producing a ripple effect on communities and the economy.

Through project finance, we help clients in the construction and infrastructure industries to help the government achieve its “Build, Build, Build” program.

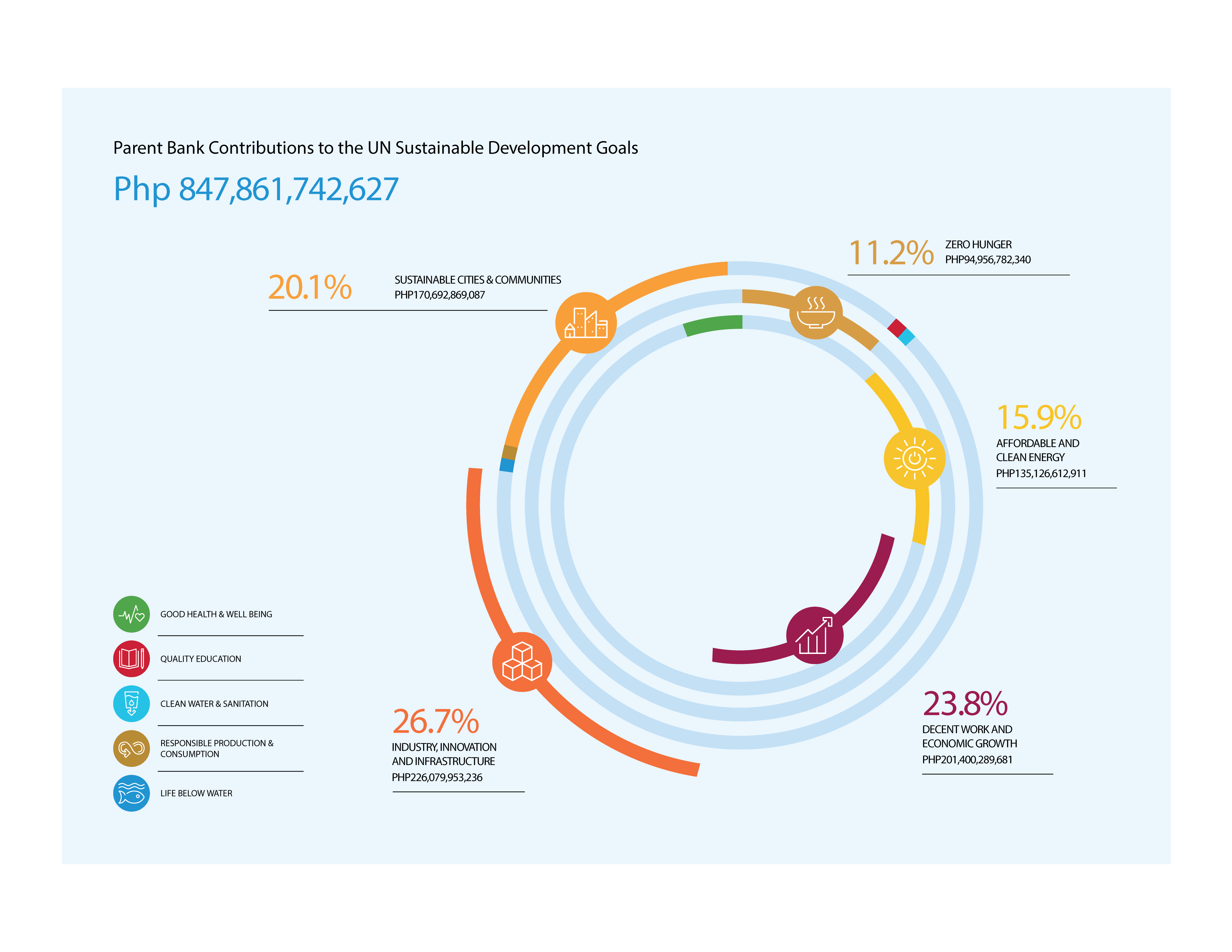

Parent Bank Contributions

To determine our contribution to meeting the UN SDGs, we reviewed our commercial loan portfolio and identified those aligned with the attainment of the SDGs based on the purpose of the loan and the client’s nature of business. We covered accounts with an outstanding loan balance of at least PHP500 million. As of December 2022, our contributions to the UN SDGs are as follows:

In addition to commercial lending, we also contributed through our Treasure and Investment Banking businesses. We participated in the Bureau of Treasury (BTr) and BSP auctions, and helped the government raise over PHP900 billion to fund COVID-affected sectors, enhanced pandemic response, and fund various sectoral projects. We also distributed over PHP700 billion in Philippine government securities to clients.