The Bangko Sentral ng Pilipinas (BSP) aims to have an integrated electronic banking and payments/settlements system to allow more consumers to complete financial transactions safely and on time. We, the Bank, and you, the Channel user, have an essential role in this endeavor.

We support the BSP’s mandate and recognize that a secure and reliable electronic banking and payments/settlements system help in improving the access and quality of financial services for the Filipino people. These are essential tools to bank swiftly, conveniently, and efficiently. They also facilitate a seamless, cost-effective, and safe transfer of payments and goods or services, which will help boost the growth of our economy. Therefore, we are extending the use of the Channels to you in support of and guided by these principles.

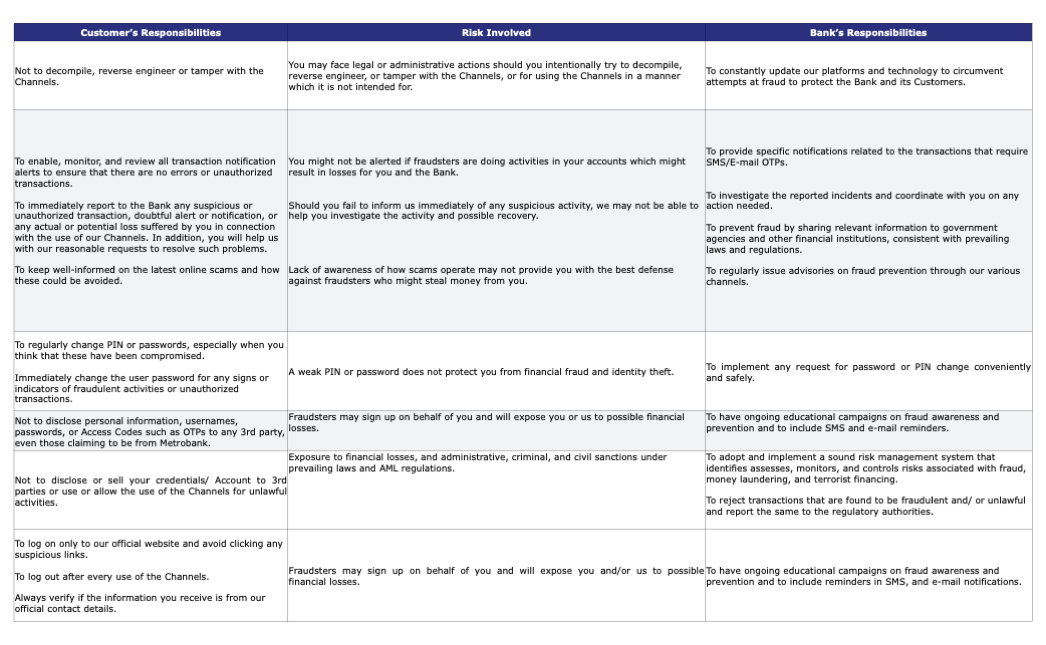

We are committed to maintaining the safety, integrity, and stability of the electronic banking and payments/settlement system. Once we grant you access to the Channels, like us, you become part of an electronic banking community and have to observe specific rules and standards for the protection and convenience of its members. In general, you must only use the Channels for their lawful and intended purposes. For your protection, always be truthful about the purpose and use of the Channels and transact only with legitimate and trustworthy counterparties (sender/beneficiary) with whom you are familiar. Protect your information and privacy at all times, especially your Access Codes to the Channels. Going against these standards undermines the reliability of the electronic banking and payments/settlement system.

Within this framework, this Metrobank Online and Metrobank App Terms and Conditions (“MBOTC”) outline our mutual responsibilities in using these electronic banking and payments/settlement systems.

I. INTRODUCTION

This MBOTC supplements the General Banking Terms and Conditions or any related agreement governing the Accounts (“GBTC”). Accordingly, capitalized terms used in this MBOTC will have the same meaning specified in the GBTC. In case of conflict between the GBTC and this MBOTC in terms of product and commercial features, the latter will prevail.

In this MBOTC, references to “us,” “we,” “our,” or the “Bank” mean Metropolitan Bank & Trust Company (“Metrobank”) while references to “you,” “your,” and “Customer” mean you as the user of Metrobank Online and Metrobank App (“Channels”).

By using the Channels and any of the services and products (“Services”) mentioned in the MBOTC, you are deemed to have carefully read, understood, and agreed to be bound by this MBOTC and to carry out your responsibilities specified herein. You should also secure, read, and understand any information related to the Accounts, Services, and Channels, together with studying any associated risks. You further confirm that you have considered all these and have accepted all the possible risks.

We may modify this MBOTC at any time, and any such change is deemed binding upon you upon prior notice in a manner we consider appropriate. You should also regularly check our website: www.metrobank.com.ph and www.metrobankcard.com for any changes or announcements related to your CASA deposit products, investments, secured and unsecured loans, credit cards, including its inherent products and channels, debit cards, personal loans, credit lines (herein collectively identified as “Accounts”), the Services, the Channels, or this MBOTC. Your continued use of the Services and the Channels shall constitute your acceptance of this MBOTC as amended.

II. METROBANK ONLINE AND METROBANK APP

Our Channels offer a quick, cost-efficient, simple, and secure way to do your banking. For example, with our Metrobank Online and Metrobank App, you can perform various services such as balance inquiries, fund transfers, and bills payments. A complete list of services is available on our website https://www.metrobank.com.ph/mbonline. Note that not all Services are available across all Channels. Agreement to this MBOTC means accepting all the terms for these Services.

A. NATURE OF OUR CHANNELS

- Our Channels allow you to access and transact in respect of your eligible Accounts with us and avail of certain Services, such as but not limited to bills payments, fund or balance transfers, or purchase of load, etc.

- By using the Channels, you also acknowledge the inherent risks associated with online transactions.

- The Channels and Services may be unavailable from time to time due to routine maintenance, excess demand on the systems, our dependencies on our technology and telecommunications partners, or for various causes beyond our control.

- Use of the Channels and Services may require you to provide any of the following-- Personal Identification Number (PIN), Card Verification Code (CVC), Card Verification Value (CVV), Customer/User ID, Passwords, One Time Password (OTP), authorization codes, fingerprint, facial recognition or other biometric modalities (collectively, referred to as “Access Codes”).

- Some features of the Channels may require access to the camera, body sensors for biometrics, calendar, contacts, location, phone, SMS, storage, etc. of your computer or mobile device. Your permission is required before accessing these from your computer or mobile device.

- Our Services may be limited to specific amounts set by law, us, or by the owner or operator of the electronic equipment or system. For example, maximum and minimum daily withdrawal amounts may vary.

- For joint OR Accounts, you agree that the Bank may process instructions sent by anyone of the account holder through the Channels.Our Channels may have clickable links that will redirect you to a third-party page, which is an external website outside Metrobank site and beyond its control. Therefore, we are not responsible for the content or any links in the third-party website or for any loss or damage arising from your access to it.

- By clicking the embedded links published on the Metrobank site, you consent to allow Metrobank to share personal data with its third-party partners to perform/complete any promotional or marketing activities.

B. OUR AUTHORITY

- We may modify the scope or suspend the Services offered through or Accounts that can be enrolled in the Channels, as well as any transaction limit, fees, cut-off times, and/or actual processing time. We will endeavor to provide sufficient notice reasonable under the circumstances.

- We may refuse to execute any instruction if: (i)you did not correctly use our Channels; (ii) the funds in the Account which you have designated, from which funds are to be used for the Channels or Service (“Source Account”) are insufficient; (iii) the authorized amount is not within the transaction limit; (iv) it was performed beyond the cut-off time; or (v) there are other circumstances beyond our control, which prevents us from implementing your instructions, despite reasonable precautions taken by us.

- We may engage clearing switch operators, payment, clearing or settlement systems, automated clearing houses, payment intermediaries, financial institutions/correspondent bank partners or other members of the Metrobank Group, mobile wallet providers and couriers, and accredited third-party service providers, whether as independent contractors, sub-contractors or agents, (collectively, “Third Party Providers”) in connection with an Account, providing you with a Service, or your use of the Channels. However, we will not be liable for any failure, error, nonperformance, or unavailability of the Third Party Providers.

- We may terminate, suspend, or deny your access to the Channels in case: (i) you are in breach of this MBOTC, the GBTC, or any other agreement with us; (ii) you have forgotten your Access Codes; (iii) it is required to comply with any legal or regulatory obligation, order of a competent court or our internal policies and procedures; (iv) you are insolvent, deceased, or had become legally incapacitated; (v) you mishandled or closed your Accounts; (vi) your Accounts may have been used or are being used for any fraudulent or illegal transactions or activities, such as but not limited to violation of anti-money laundering and terrorist financing laws; (vii) such action is required to protect our system from harm, including any form of denial of service attack or from viruses or malicious codes; (viii) your computer or mobile device is suspected to be jailbroken and rooted and/or on developer mode (ix) in our judgment, your continued access to the Channels may expose us to any financial, operational, legal, reputational or other risks; or (x) you have not used the Channels for more than one (1) year. Unless the law or our policies provide otherwise, we will provide you with sufficient prior notice of termination or suspension, reasonable under the circumstances.

C. INSTRUCTIONS

- You may send instructions to avail of any of the Services using the Channels, which shall only be considered received when you receive our confirmation, or we have actually executed such instruction.

- Your Access Codes are very important since they serve as your authorization for us to implement your instructions. Therefore, you should never share your Access Codes with anyone. Any instructions using your Access Codes shall be considered complete, irrevocable, and binding against you, your successors, beneficiaries, and/or other interested parties. Instructions are still conclusive even if you were defrauded into disclosing your Access Codes, or failed to, or were negligent in adequately securing your computer/mobile devices against malware or any kind of unauthorized access or use of the Channels. Except for verifying your instructions and authentication of your Access Codes, we are not obligated to investigate the authority of the person sending the instructions or the Access Codes unless we have a reason to do so.

- You acknowledge that receipt of any OTP or any Access Code for your instructions will depend on factors beyond our control, such as your mobile device, internet connection, or telecommunications service provider.

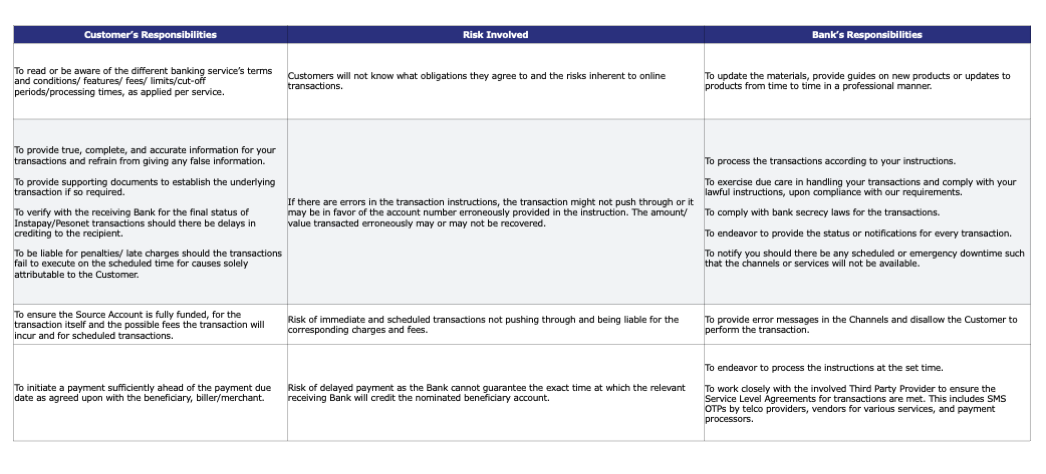

- You are responsible for ensuring the accuracy of all instructions and information when using the Channels. We may verify an instruction if we have reason to believe there is an error, fraud, or breach of security through any method we deem fit.

- You are responsible for ensuring that you have sufficient funds in your Accounts for us to process your instructions. If you unenrolled an Account, any scheduled transaction or payment on the Account will not be processed.

- You acknowledge and agree that some instructions may not be processed immediately as these are dependent on the time or day that such was received by Metrobank or may further be processed by a Third-Party Provider. You are also responsible for determining whether the applicable processing time is acceptable for your purposes.

- Any instruction received after the relevant cut-off time will be treated as an instruction received on the next business day.

- You will be solely liable for any losses, damages, penalties, or charges that will be imposed arising from the non-processing of your instruction due to insufficient funds, closed or dormant Account/s, or a court or regulatory order, which effectively prohibits any transaction to your Accounts.

- We may, at any time, cancel or refuse to execute any instruction based on our reasonable judgment without incurring any liability. We will endeavor to provide you with sufficient notice, likely under the circumstances.

- You will immediately notify us if you receive any information through the Channels which was not intended for you. You will also delete such information and keep the same confidential.

- You authorize us to debit any of your Accounts for fees and charges applicable to the specific product or Services you availed using our Channels. We will not execute your instructions if insufficient funds are in your Account/s for the said fees and charges.

- You recognize that the Channels, other materials, or information provided to you and all rights, trademarks, and interests contained therein belong to us or Third Party Providers.

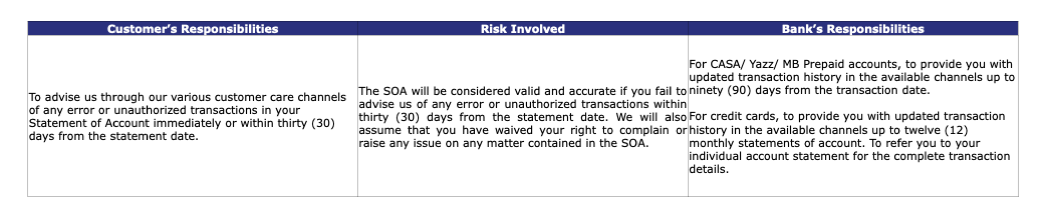

- Except for manifest error, you agree that our records of any instruction processed through the Channels are final, conclusive, and binding to you.

- Metrobank will comply with its obligations following regulatory requirements and the standards and generally recognized banking industry practices.

Please check our website: https://www.metrobank.com.ph & www.metrobankcard.com, or our various communication channels to access the latest information on our Channels, Products, and Services, as well as the relevant fees and charges (https://www.metrobank.com.ph/articles/rates-and-fees and https://metrobankcard.com/cards/compare-all).

D. INSTAPAY/PESONET

For InstaPay and PESONet, you understand and agree to the following:

1. DEFINITIONS

a. “Automated Clearing House (ACH)” - a multilateral agreement among ACH participants governing the clearing and settlement of payment orders for specific payment streams operating under the National Retail Payment System (NRPS) consisting of the InstaPay and PESONet credit payment schemes:

i. “InstaPay”- a real-time low-value electronic fund transfer (“EFT”) credit push payment scheme.

ii. “PESONet”- a batch EFT credit payment scheme whereby the funds transfer instructions will be processed in bulk and cleared at batch intervals. The recipient of funds or Beneficiary will then receive the total value in their account within the same banking day, provided the payment instruction of the Sender is sent within the prescribed cut-off time/s.

b. “Beneficiary” -the receiving party identified by the Sender of funds in the Interbank Fund Transfer Instruction

c. “Beneficiary Account”- the account maintained with the Receiving Institution that is identified by the Sender as the account to be credited with the amount specified in the Interbank Fund Transfer Instruction

d. “InstaPay QR”- a feature that enables the transfer of money between accounts in different banks and e-wallets by scanning a QR code instead of typing and sharing account numbers. It follows the QR Ph standard.

e. “Interbank Fund Transfer Instruction or IBFT Instructions”-the Instruction submitted or entered by the Sender in the Channels to transfer funds from the Source Account for credit by the Receiving Institution to the Beneficiary Account

f. “Sender”- the party initiating the IBFT Instruction through the Originating Institution to transfer funds from his/her/its identified Source Account to the Beneficiary Account

g. “Source Account” – the account maintained by the Sender with the Originating Institution, which is identified by the Sender as the account to be debited with the amount specified in the IBTF Instruction

2. CONDITIONS OF USE

You further agree to the following conditions:

a. The use of InstaPay and PESONet is subject to change and enhancements by the ACH or the Bank’s own system enhancements.

b. All transactions completed through InstaPay are real-time, irreversible, and considered final and binding against you.

c. We have the right to unilaterally disable/enable the InstaPay or PESONet service or disable/enable sending to or receiving from certain InstaPay or PESONet participants in case such action is required for security purposes or system enhancements or for any other justifiable reasons. We will provide you with such notices reasonable under the circumstances.

d. InstaPay or PESONet transactions are subject to cut-off, processing times, transaction limits, and fees, which may be amended from time to time, subject only to the Bank’s policy and reasonable prior notice. You further authorize us to automatically deduct the fees from the Source Account on top of the amount indicated in the IBFT Instructions.

e. You agree to fully cooperate in case of any investigation related to your IBFT transaction and provide the necessary documents and testimonies as we may require.

f. Before sending any IBFT Instruction, you must carefully read and consider related service advisories provided by us.

g. You, as a Sender, agree that it is your sole responsibility to ensure that all the details entered into the IBFT Instruction are complete and accurate. This applies to all IBFT instructions via manual input or InstaPay QR to (i) pay peers; (ii)pay merchant; and (iii) pay biller

h. You acknowledge that for implementing an IBFT Instruction for peer-to-peer transfers, the account number is only sufficient to be consistent with the specified Beneficiary Account.

i. You further understand that we are not a party to any agreement between you and the Beneficiary, Merchants, or Billers in connection with the IBFT Instruction. As such, in the absence of gross negligence and willful misconduct, we have no obligation or liability if: i. funds were not transferred to the Beneficiary Account due to insufficient funds or erroneous or invalid account numbers or details; ii. there was an overpayment or insufficient funds transferred to the Beneficiary Account; or iii. there was any wrongful payment since you did not receive the item you paid for. iv. there was a scam/sale of defective products/services by the merchant you paid.

j. In case of insufficient funds in the Source Account or should there be any discrepancies or issues with the IBFT Instruction (such as, but not limited to, incorrect amount or wrong beneficiary), you agree to coordinate directly with the Beneficiary to settle the amount due.

k. Upon authorizing the IBFT instruction, you agree to hold free and harmless and indemnify us for any expense, loss, or damage incurred by us due to our reliance on the information provided or for acting upon your IBFT Instruction.

E. CUSTOMER CARE AND LIABILITY

a. We will endeavor to resolve issues and claims, reasonably, timely, and efficiently. You agree to cooperate with us and provide us with the necessary information to resolve any issue or complaint. Subject to existing laws and our policies, we will provide you with the results of our investigation. For any questions or concerns, you may reach us through the following points of contact:

- 24x7 Customer Hotline: (632) 88700-700

- 24x7 Domestic Toll-free No: 1-800-1888-5775

- E-mail: customercare@metrobank.com.ph, customerservice@metrobankcard.com

- Website: https://metrobank.com.ph/home, https://www.metrobankcard.com

- Social Media:

- Facebook Page: https://www.facebook.com/metrobank, https://www.facebook.com/metrobankcardph

- Twitter: @Metrobank, @metrobankcardph

- Instagram: @metrobank, @metrobankcardph

Metrobank is regulated by the Bangko Sentral ng Pilipinas (https://www.bsp.gov.ph).

b. In case of disputes arising from erroneous handling of unauthorized transactions, the Bank will investigate and provide you with a fair opportunity to present your allegations and evidence.

c. We acknowledge our responsibility to exercise the highest degree of diligence and good faith in performing our obligations to you. Accordingly, we will abide by any final adjudication by a court of competent jurisdiction if we are proven and found to have acted otherwise.

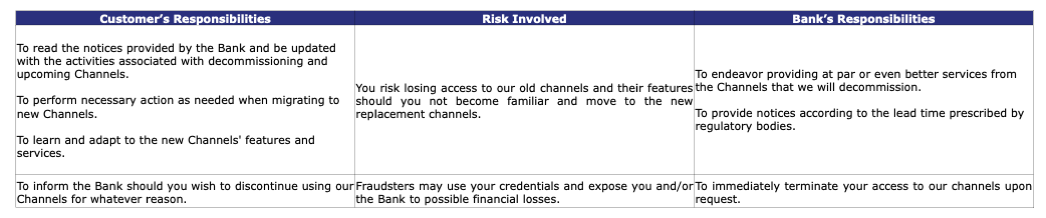

III. CHANNELS LIFECYCLE

A. SIGN UP

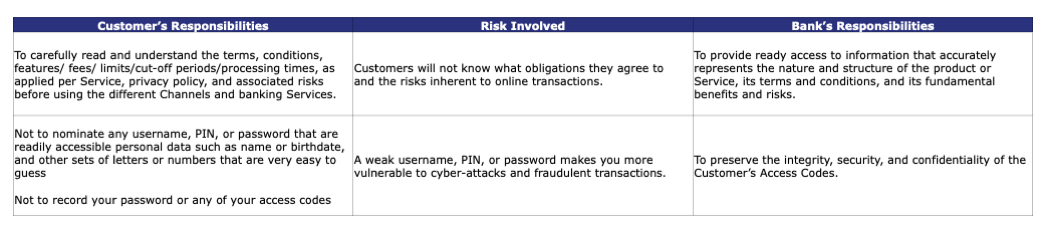

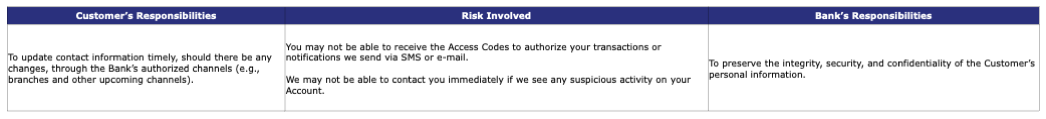

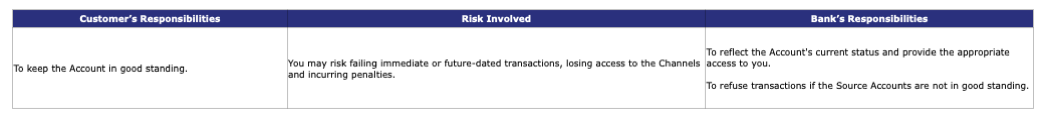

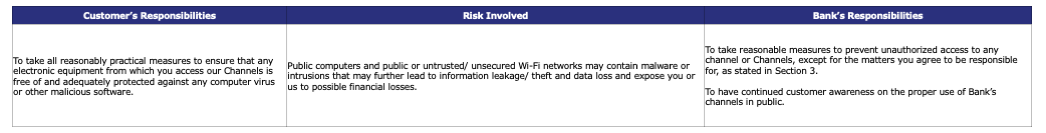

B. USE OF CHANNELS

- Updating of Contact Information

- Account Maintenance

- Login credentials/ access codes

- Authorized browsers/ devices

- Performing transactions

- Maintenance of Channels

- Others

C. MONITORING AND RECONCILIATION OF TRANSACTIONS

D. TERMINATION OF ACCESS/ DECOMMISSIONING OF CHANNELS