FAQs about Metrobank's 2022 AXA Protect Package

CUSTOMER-RELATED QUESTIONS:

Q: WHAT IS THE PROMO?

A: The promo allows an eligible client to get FREE AXA Protect Package, which includes PHP100,000 Personal Accident (PA) Insurance with in-hospital benefit of up to PHP 5,000, and free access to the AXA Rescue Line, for every account* opened.

- The client must open any eligible product at any Metrobank branch during the promo period.

- Maximum of two PA + DHI allowed per person.

Q: WHEN IS THE PROMO PERIOD?

A: The promo period is from May 16, 2022 to December 31, 2022.

Q: WHO ARE QUALIFIED FOR THE PROMO?

A: Clients must meet the following criteria to qualify for the FREE AXA Protect Package:

- Open a participating Savings/Checking account during the promo period

- Must be 18 to 70 years old at the time of account opening

- Must provide a valid email address

- Sign/agree to the Data Consent Form upon account opening

- Register using a unique code, complete all required information, and agree to the terms and conditions in the AXA Registration page. The unique code and registration page link are provided in the email sent by Metrobank.

Q: WHAT ARE THE PARTICIPATING PRODUCTS?

A: All Checking/Savings account products* (PHP and FCDU), except for Fun Savers Club (716 – PHP and USD), payroll accounts and corporate accounts are included in the promo.

*Refer to ANNEX A for the complete list of eligible accounts.

Q: WHY ARE FUN SAVERS CLUB 716 PHP AND USD NOT INCLUDED IN THE PROMO?

A: The two account types are no longer included in the promo because they already have an insurance component.

Q: ARE TIME DEPOSITS CONSIDERED A PARTICIPATING PRODUCT TO AVAIL OF THE PROMO?

A: No. Time Deposits are not included in the promo. Only Savings/Checking accounts as indicated in Annex A are eligible.

Q: IF I AM AN EXISTING METROBANK ACCOUNTHOLDER, AM I ELIGIBLE FOR THE PROMO?

A: You need to open another Savings/Checking account during the promo period in order to qualify for the promo.

Q: WHY DO I NEED TO SIGN/AGREE WITH THE DATA CONSENT FORM?

A: The Data Consent Form is in compliance with the Data Privacy Act of 2012 (RA 10173) on the collection, access, use, disclosure, or other processing necessary to the purpose, function, or activity of personal data. For this promo, you need to sign the form in order for AXA to activate your insurance coverage.

Q: WHY DO I NEED TO PROVIDE AN EMAIL ADDRESS?

A: It is through this email address that your AXA Protect Package coverage details will be delivered.

Q: YOU DID NOT RECEIVE AN EMAIL CONFIRMATION, BUT YOU WERE COMPLIANT TO THE FIVE CRITERIA ABOVE, ARE YOU STILL QUALIFIED TO CLAIM INSURANCE?

A: Yes, you are still qualified to claim your insurance. If you did not receive a confirmation email or text message, please contact the AXA Philippines Customer Care hotline at (02) 8 581-5292.

Q: YOU DON’T HAVE AN EMAIL ADDRESS, WHAT WILL YOU DO?

A: One of the criteria to be pre-qualified to the promo is having a valid email address. To avail the offer, use the email address you have registered with Metrobank during account opening when accomplishing the AXA registration form.

Q: YOU OPENED A JOINT ACCOUNT. WILL YOU AND YOUR SPOUSE BE QUALIFIED FOR THE AXA PROTECT PACKAGE?

A: Joint (and/or) and In-Trust-For (ITF) account holders may receive one AXA Protect Package only. Only the primary account holder will be qualified for the promotion.

Q: CAN I ADD MORE DEPOSITS TO GET MORE AXA PROTECT PACKAGE?

A: No. Should you wish to get another AXA Protect Package, you will have to open another participating account.

Q: IF I OPEN MORE THAN ONE (1) CHECKING/SAVINGS ACCOUNT WITH METROBANK, HOW MANY AXA PROTECT PACKAGES WILL I RECEIVE?

A: You may only be given a maximum of TWO (2) free AXA Protect Packages. This will cap your free coverage to PHP 200,000.00. Each package will serve as one policy and may be availed simultaneously or individually.

Q: IS THE AXA PROTECT PACKAGE FOR SALE?

A: No, the AXA Protect Package is not for sale.

INSURANCE-RELATED QUESTIONS:

Q: WHAT ARE THE BENEFITS OF THE AXA PROTECT PACKAGE?

A: The benefits of your FREE PA with Daily In-Hospital Insurance are as follows:

- Accidental Death and Permanent Disablement up to PHP 100,000

- Daily In-Hospital Benefit up to PHP 5,000 (P500 per day – minimum of three consecutive days and maximum of ten [10] days)

- Free access to 24/7 emergency services such as roadside, ambulance, fire, and police assistance using the Emma by AXA PH App

Q: WHAT IS DAILY IN-HOSPITAL BENEFIT?

A: Daily In-Hospital Benefit pays you PHP 500 per day in the event that you are hospitalized/confined in a hospital for a minimum of three (3) consecutive days or seventy-two (72) hours due to an accident.

Q: DO I NEED TO ACTIVATE MY AXA PROTECT PACKAGE INSURANCE?

A: No need. Your free AXA Protect Package Insurance will automatically take effect at 12:00 NN of the following day you completed AXA's registration form and agree to the campaign terms and conditions specified. It shall be valid for one (1) year from the date of successful registration. You will also be receiving a confirmation email of your insurance coverage from AXA Philippines.

Q: HOW LONG WILL I BE COVERED UNDER PA?

A: Coverage will be effective for one (1) year from the date of successful registration.

Q: IS THERE A GEOGRAPHICAL LIMITATION IN MY PA COVERAGE?

A: None. This PA coverage is effective worldwide.

Q: IS THERE AN AGE LIMIT FOR THIS COVERAGE?

A: Yes. Clients from 18 to 70 years old during the policy period are qualified to avail.

Q: I WANT TO CONTINUE MY PA INSURANCE AFTER ONE (1) YEAR. CAN I RENEW MY COVERAGE?

A: This coverage cannot be renewed. You may reach out to our representatives via the AXA Customer Care hotline at 02 8 5815-292 to learn more.

Q: CAN I APPOINT MY BENEFICIARY?

A: Your beneficiary will automatically be your next of kin in accordance with the Philippine law.

Q: DOES CLAIMING MY DAILY IN-HOSPITAL BENEFIT INSURANCE AFFECT MY ACCIDENTAL DEATH & DISABLEMENT COVERAGE?

A: No, your Daily In-Hospital Insurance (DHI) is separate from both your Accidental Death and Disablement Coverage. However, your DHI is a per occurrence-based coverage. This means, you may only claim a maximum of 10 days or PHP 5,000.00 max per occurrence. This can accumulate.

Q: WHAT IS AN ACCIDENT?

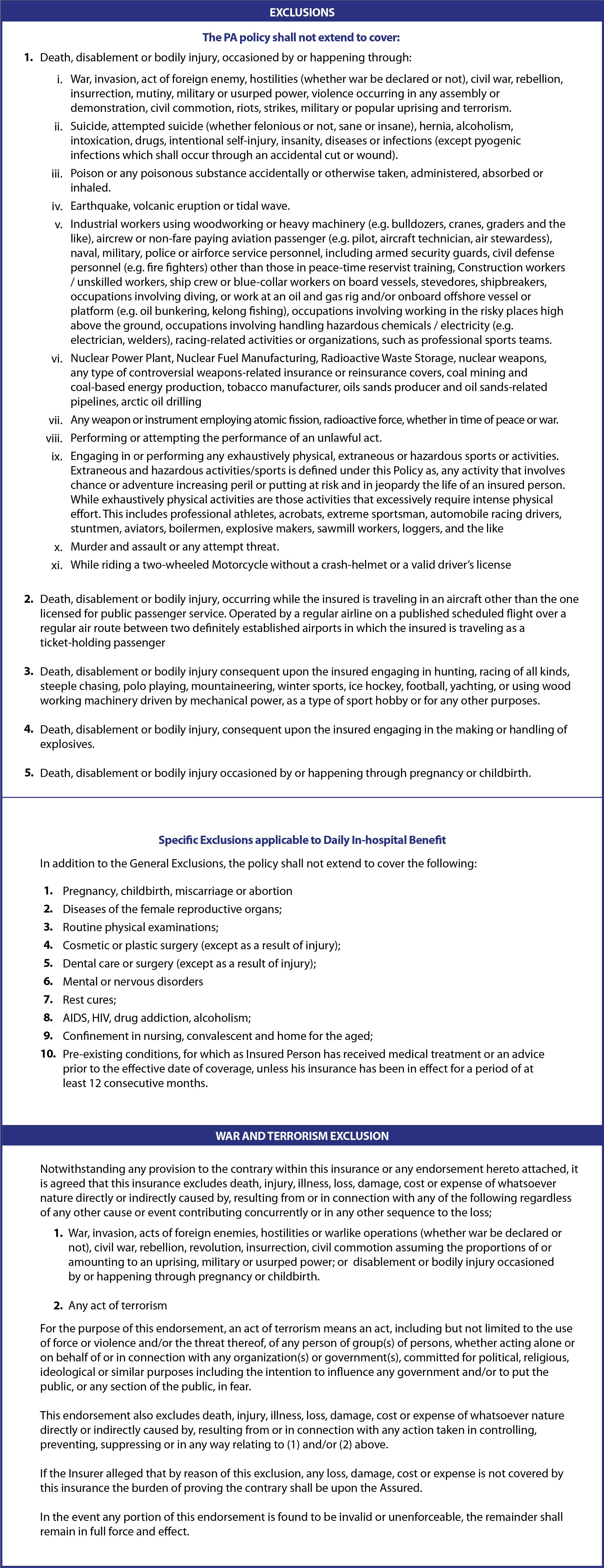

A: Accident is a sudden, unforeseen, and fortuitous event which occurs during the period of insurance which solely results in injury and which is not caused by illness or naturally occurring medical condition/s. Please refer to exclusions below:

Q: HOW DO I MAKE A CLAIM?

A: In case of accidental death, a written notice to AXA Philippines must be given immediately. For permanent disablement, written notice must be given within 30 days. The claim requirements are as follow:

Accidental Death Claim

1. Personal Accident Claim Report Form – duly accomplished and signed

2.Attending Physician Statement or Medical Certificate (original or Certified True Copy/CTC)

3. Police Investigation Report and Statement of Witnesses (original or CTC)

4. Birth Certificate (original or CTC) – insured/victim

5. Death Certificate (NSO certified) – insured/victim

6. Autopsy Report, if needed (original or CTC)

7. Marriage Contract, if married (original or NSO certified)

8. Two (2) Government-Issued IDs

Permanent Disablement

1. Personal Accident Claim Report Form – duly accomplished and signed

2. Attending Physician Statement or Medical Certificate (original or CTC)

3. Police Investigation Report and State of Witnesses (original or CTC)

4. Birth Certificate (original or CTC)

5. Official Receipts – for additional medical expenses (original copy)

6. Hospital Records – for amputation and operation performed by attending physician

7. Picture of Amputated/Affected Body Part/s of the Victim

a. Whole body

b. Close shot of the affected body parts

8. Two (2) Government-Issued IDs

Daily In Hospital Benefit

1. Personal Accident Claim Report Form – duly accomplished and signed

2. Attending Physician Statement or Medical Certificate (original or CTC)

3. Police Investigation Report and State of Witnesses (original or CTC)

4. Official Receipts – original copy

5. Statement of Account (SOA) issued by the hospital with admission date and discharge date – original copy

6. Two (2) Government-Issued IDs

Rescue Line FAQs:

Q: WHAT ARE THE EMERGENCY ASSIST SERVICES?

A: Refer to the table below

Q: WHO IS OUR SERVICE PROVIDER?

A: Assist and Assistance Concept Inc. (AAC)

- 100% owned by AXA France

- Makati-based office with dedicated AXA Command Center to handle assistance for roadside, police and fire, and ambulance services

- Available nationwide: First Responder – quick response to members (within Metro Manila)

- GPS Tracker for roadside services to provide status update to customer via SMS or call

Q: HOW DO I AVAIL OF AXA RESCUE LINE SERVICE?

A: You may avail of the AXA Rescue Line service by downloading the EMMA by AXA PH App. Once downloaded, you may proceed to register your account, including nominating three (3) emergency contacts to send SMS alerts/notifications in the event of an emergency situation.

Q: DO I HAVE TO PURCHASE AN AXA INSURANCE POLICY TO AVAIL OF AXA RESCUE LINE?

A: No, you do not need to purchase an AXA insurance policy. As part of AXA's Know You Can Campaign, access to AXA Rescue Line is free. Just download the Emma by AXA PH app.

Q: HOW MANY EMERGENCY CONTACTS CAN I NOMINATE?

A: For AXA Rescue Line service, you may nominate a maximum of three (3) emergency contacts.

Q: WHEN CAN I AVAIL OF THE SERVICE?

A: Please complete adding your Emergency Contact prior availing of the service.

Q: HOW MUCH IS THE COST IF I AVAILED ANY SERVICE VIA RESCUE LINE?

A: Rates will vary depending on the location and service needed at the time of your need. For services like Fire and Police, no cost is incurred.

Q: IS THE CALL FREE?

A: Local network charges for call to landline will be applied to your prepaid/postpaid account.