Post-office scammers threaten you into giving them what they want–your personal info, bank details, and money.

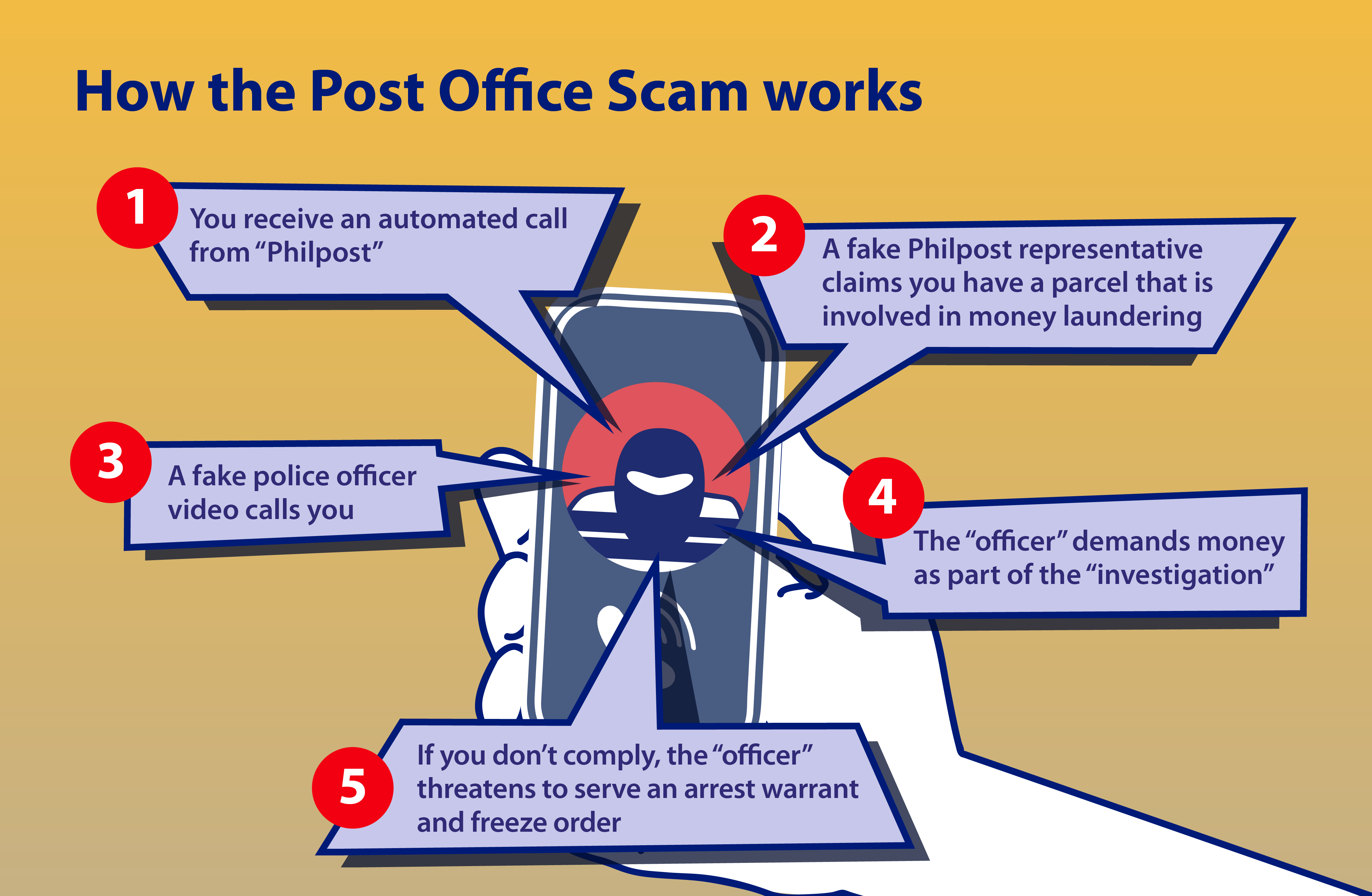

You receive an automated call from “Philpost”. The call instructs you to press 9 which directs you to a fake Philpost representative.

The fake Philpost representative claims you have a parcel that is involved in money laundering. The fake representative informs you that you will be blacklisted from Philpost because your parcel contains questionable items, such as bank cards and passports, allegedly involved in money laundering. When you deny the allegation, the “representative” suggests that you might be a victim of identity theft, and refers you to the “PNP”.

A fake police officer video calls you. The fake officer informs you that your name is on the PNP’s list of money launderers. When you deny the allegation, the “officer” instructs you to send your bank account details, IDs, and screenshots of your mobile banking transactions so the PNP can “investigate” your banking activities.

The “officer” demands money as part of the “investigation”. The fake officer orders you to transfer funds to an e-wallet. This serves as your “digital footprint” needed for the Anti-Money Laundering Act of 2001 (AMLA) investigation.

If you don’t comply, the “officer” threatens you by serving an arrest warrant and freeze order.

If you get this call, even if it’s allegedly from Philpost or the PNP, stay calm and don’t give the caller the power to intimidate you. Here’s what you should do:

- NEVER share personal info, bank details, and screenshots of your mobile banking app transactions.

- VERIFY the phone numbers before responding. Know that caller IDs can be easily spoofed.

- THINK before you act. Don’t just press buttons or respond to prompts from an automated voice message.

- BLOCK unidentified callers.