5 MIN READ

Our Approach to Sustainability

We empower individuals, businesses, and communities through inclusive finance, balancing present needs with long-term value for our stakeholders.

Sustainability Focus Areas

Metrobank drives inclusive, resilient growth through five sustainability pillars aligned with SDGs, community impact, and strategic investments.

Sustainability is not just a responsibility but a strategic foundation for building a resilient, inclusive, and future-ready society. Guided by five key pillars, our approach drives both societal progress and long-term business growth. Through targeted investments, tailored financial solutions, and high-impact community programs, we actively support national development while aligning with global sustainability standards.

Commitment to the UN SDG

Metrobank’s sustainability approach is built on five core pillars that promote resilience, inclusivity, and long-term growth. We align with global benchmarks and advance the 17 UN Sustainable Development Goals (SDGs) through strategic financing, specialized services from our subsidiaries, and impactful community programs led by the Metrobank Foundation and Purple Hearts Club.

SDG 1: No Poverty– Providing accessible financial services to support income-generating activities and poverty alleviation.

SDG 2: Zero Hunger – Supporting food security and sustainable agriculture through financing and community programs.

SDG 4: Quality Education – Investing in scholarships, lifelong learning opportunities, and education-focused initiatives.

SDG 8: Decent Work & Economic Growth – Stimulating economic development through MSME financing, job creation, and responsible banking practices.

SDG 9: Industry, Innovation & Infrastructure – Financing sustainable urbanization, resilient infrastructure, and industrial innovation.

While contributing across all SDGs, we prioritize five: ending poverty through accessible financial services; achieving food security via sustainable agriculture and nutrition programs; promoting quality education and lifelong learning; enabling decent work and inclusive economic growth; and supporting resilient infrastructure and innovation.

These efforts reflect our core belief in creating meaningful value for clients, communities, and society by integrating sustainability into everything we do.

Materiality Process

Understanding the priorities and concerns of our stakeholders is central to our sustainability efforts. We conduct a formal materiality assessment to engage a diverse group of stakeholders, including customers, employees, Board directors, senior management, suppliers, investors, regulators, and community program beneficiaries. This process helps us identify the ESG issues that matter most to them. The insights we gain guide our strategy, inform our communication, and strengthen our sustainability narrative. Focusing on the ESG topics with the greatest impact ensures that our efforts remain relevant, targeted, and meaningful.

| Economic and Governance | Environmental | Social |

|---|---|---|

| ● Economic Performance ● Business Ethics ● Systemic Risk Management ● Business Model Resilience and Innovation ● Supply Chain Management ● ESG Considerations in Products and Services |

● Energy Management ● Greenhouse Gas Emissions ● Water and Wastewater Management ● Waste and Hazardous Materials Management ● Ecological and Biodiversity Impact ● Environmental Compliance |

● Access and Affordability ● Selling Practices and Product Labelling ● Customer Welfare and Satisfaction ● Data Security and Customer Privacy ● Community Relations ● Employee Engagement ● Diversity and Inclusion ● Human Rights and Labor Practices ● Employee Health and Safety |

|

|

|

| *Physical Impact of Climate Change falls under Systemic Risk Management as it poses material risks to operations, infrastructure, and business continuity. | ||

We categorize our material sustainability topics into three core areas: Economic and Governance, Environmental, and Social. These reflect what matters most to our stakeholders and our business. Our focus includes ethical practices, risk management, ESG integration, resource efficiency, climate and biodiversity impact, customer welfare, data privacy, and employee well-being. Each area aligns with key UN Sustainable Development Goals and helps shape our strategy to deliver meaningful and responsible impact.

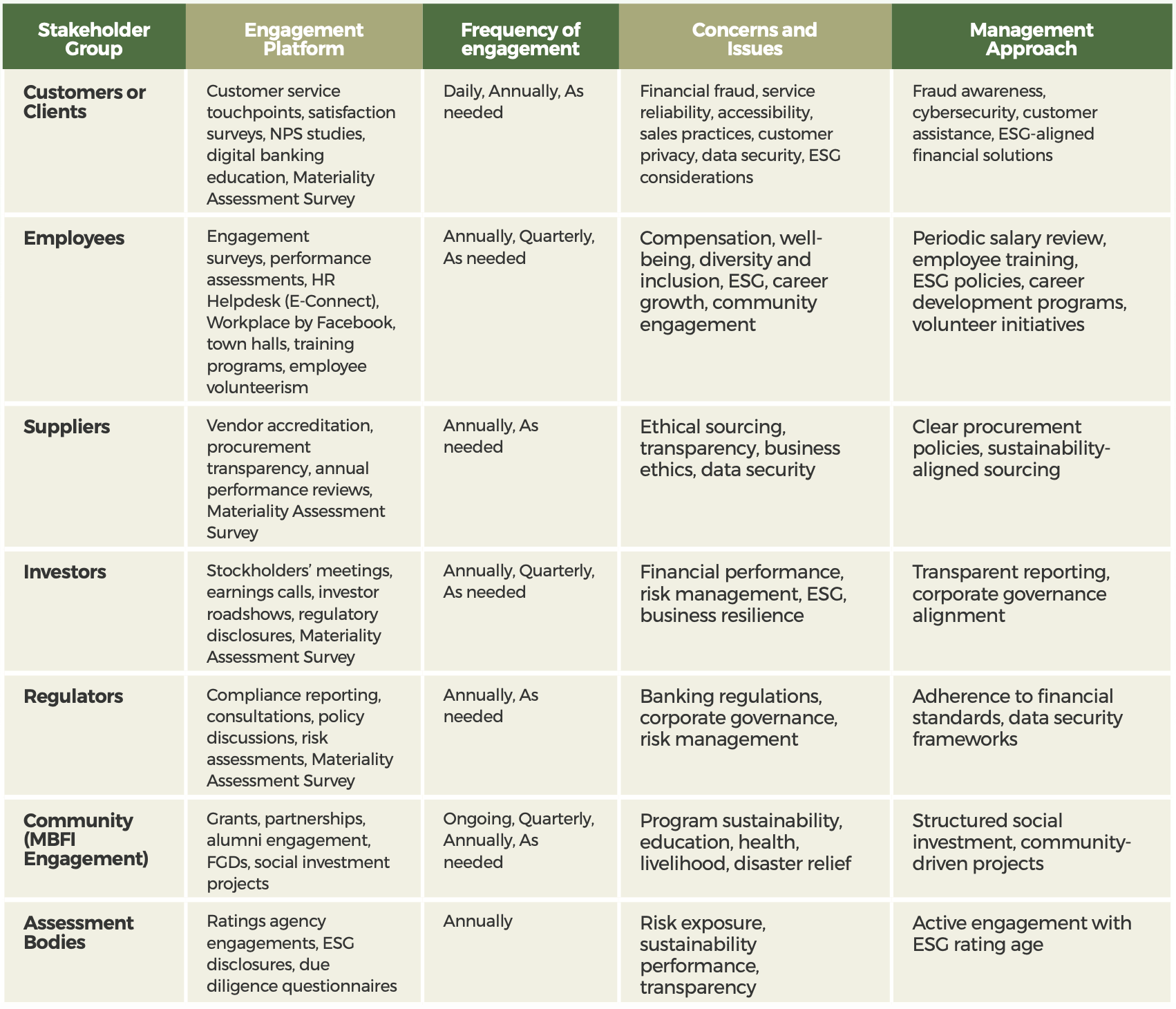

Stakeholder Engagement Overview

Metrobank builds strong stakeholder relationships through ongoing engagement that supports our corporate, financial, and sustainability goals. We foster collaboration and respond to the needs of customers, employees, investors, regulators, and communities to create value and drive positive impact.