5 MIN READ

Sustainable Finance

At Metrobank, sustainability means empowering individuals, businesses, and communities through financial solutions that drive inclusive national growth. Guided by our promise, “You’re in Good Hands,” we balance present needs with future goals by integrating economic, environmental, and social considerations into our decisions and ensuring long-term value for our stakeholders.

Sustainability Framework

Metrobank’s Sustainable Finance Framework (SFF) reflects our commitment to embedding ESG principles into our operations, risk management, and financial activities, in line with BSP Circular No. 1085 and supporting regulations on E&S risk, sustainable investments, and the Philippine Sustainable Finance Taxonomy. It also aligns with SEC Memorandum Circular No. 4, Series of 2019, which outlines sustainability reporting standards for publicly listed companies. The SFF includes an exclusion list that prohibits financing for illegal or harmful activities, and incorporates E&S due diligence tools to evaluate project impacts and ensure continuous risk monitoring, supporting climate-responsive and responsible banking.

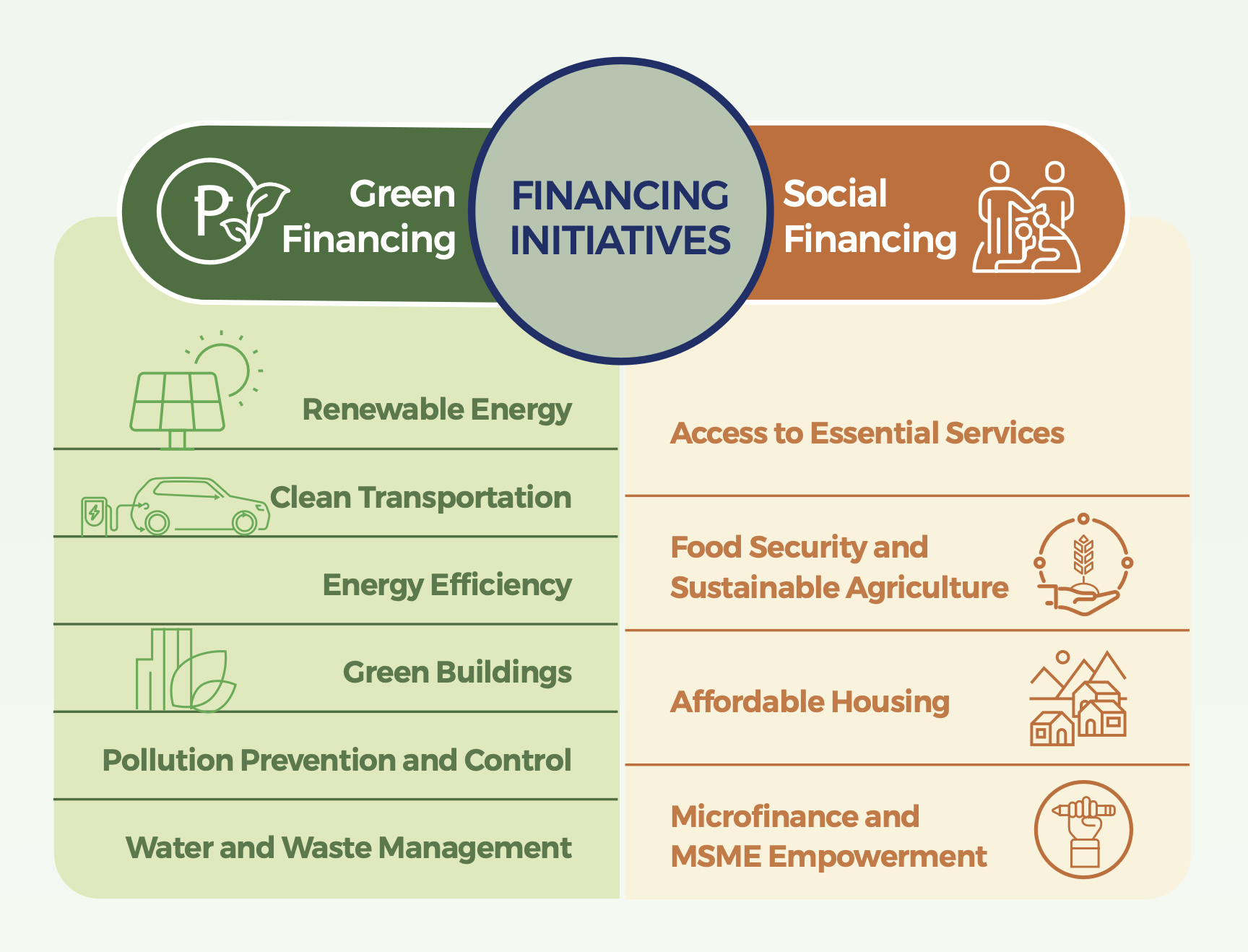

Eligible Use of Proceeds – Driving Green and Social Impact

Metrobank allocates proceeds from its sustainable financing instruments to projects that deliver measurable environmental and social benefits. These efforts focus on promoting climate resilience, enhancing resource efficiency, expanding public infrastructure, and improving access to essential services. Through targeted green and social financing, we support inclusive economic growth and contribute to a more sustainable and equitable future for all.

Impact Metrics for Eligible Categories

We are committed to transparency in fund allocation by tracking key sustainability indicators to ensure that each investment delivers measurable, positive outcomes.

Environmental metrics include avoided GHG emissions from renewable energy, energy savings from efficiency upgrades, reductions from clean transportation, and compliance with green building certifications. We also monitor waste management performance, water savings, and treatment capacity under water resource initiatives.

On the social front, we measure the number of housing units financed for low-income communities, development of essential services such as schools and hospitals, and beneficiaries of sustainable agriculture programs to support food security and inclusive growth.

How We Assess Risk in Lending

Metrobank uses a structured due diligence process to evaluate environmental and social (E&S) risks in lending and investment decisions, ensuring responsible and sustainable financing. Borrowers are categorized as High, Medium, or Low risk based on their E&S exposure, sector vulnerabilities, and alignment with our sustainability principles.

Sector-Specific Monitoring – We evaluate climate-sensitive industries (e.g., energy, agriculture) and sectors with heightened social risk exposure (e.g., supply chain-dependent businesses).

Integration into Credit and Investment Decisions – Borrowers and investment counterparties undergo comprehensive risk screening to ensure compliance with applicable guidelines and standards.

Metrobank employs a due diligence scorecard to assess E&S risks, assigning weights to various factors to ensure consistent, standards-based risk screening.

| Parameters | Considerations |

|---|---|

| Environmental | Climate risk management (physical and transition risks), resource management, pollution control, biodiversity protection. |

| Social | Labor rights, workplace health and safety, community relations, data privacy, cybersecurity. |

| E and S Common Parameters | Corporate responsibility, sustainable procurement practices, business continuity management. |

Our Commitment to Sustainable Growth

We integrate environmental and social priorities into financing decisions to create meaningful impact across sectors. Through responsible investments and sustainability-linked financing, we support a just energy transition, stronger communities, and resilient businesses.

● A just energy transition – Reducing emissions and expanding clean energy ● Stronger communities – Enhancing access to housing, healthcare, and education ● Resilient businesses – Supporting MSMEs, sustainable agriculture, and financial inclusion

Sustainable Finance Projects in Action

We actively mobilize capital toward high-impact projects that advance sustainability in renewable energy, infrastructure, and water management. These initiatives support our country’s transition to a low-carbon and climate-resilient economy, while improving quality of life through better services and environmental protection. Each project reflects our commitment to the UN Sustainable Development Goals, allowing us to create lasting value for our communities and our planet.

| Project Name | Sector | Project Description | Financing Type | Amount Mobilized (PHP) | Sustainability Impact | Alignment with SDGs |

|---|---|---|---|---|---|---|

| ACEN Maiden Green Loan | Renewable Energy | Supporting the expansion and development for the Phase 2 of the Palauig Solar Project in Zambales |

Green Loan | 4.5 billion (MBTC financed this term loan) |

Reducing annual carbon emissions and supplying clean energy to households. |

|

| Ayala Land Sustainability Linked Bond | Infrastructure | Supporting efforts to reduce emissions in commercial properties |

Sustainability Linked Bond | 8.0 billion (FMIC as one of the joint lead underwriters) |

Commitment to reaching net-zero emissions by 2050. |   |

| Maynilad Blue Bond | Water Resource Management | Financing water and wastewater infrastructure projects to improve sustainability | Blue Bond | 15 billion (FMIC as one of the joint lead underwriters) |

Enhanced water access and quality, supporting environmental stewardship |

|

Metro Clean Energy Equity Feeder Fund

The Metro Clean Energy Equity Feeder Fund offers clients with higher risk appetite a way to invest in global clean energy through a professionally managed UITF. It focuses on renewable energy, alternative fuels, and energy-efficient technologies by investing in the BlackRock Sustainable Energy Fund. This fund allows peso-based investors to access dollar-denominated assets while supporting the transition to a low-carbon future.

| Metro Clean Energy Equity Feeder Fund | |

|---|---|

| Clients served | 214 |

| Transaction count | 514 |

| Volume | PHP 15.6 M |

Financial Inclusion

Metrobank champions financial inclusion by offering a wide range of accessible and affordable products and services tailored to meet the evolving needs of Filipinos, wherever they are in their financial journey.

Access and affordability: More than half of our branch network is located outside Metro Manila, ensuring service to underserved areas. As of 2024, 390 branches (54.9% of our total) are in key provincial hubs. Our global footprint, including 5 foreign branches and 100 international remittance partners, facilitated USD 10.02 billion in remittances, supporting overseas Filipinos and their families.

MSME empowerment: MSMEs are vital to national growth. In 2024, we supported 3,042 MSME borrowers with PHP 34.4 billion in loans. Our Business Banking Center (BBC) drives digital onboarding through Metrobank Business Online Solutions (MBOS), while our SME loan offerings—like SME Puhunan, Franchise, and Agri Business Loans—meet diverse funding needs.

Inclusive financial products: We offer low- to zero-maintaining balance savings accounts for youth (Fun Savers Club, Spark Savings), overseas workers (OFW Savings), and retirees (SSS and US Pensioner Accounts), serving over 600,000 clients in 2024. Unit Investment Trust Funds (UITFs), Metro Aspire Funds, and PERA funds enable wealth-building with low barriers to entry.

Digital banking: The Metrobank App’s Cash Pick-Up feature and expanded capabilities enabled 92.3 million financial transactions in 2024, reflecting greater trust in secure and seamless banking. Over 14,000 remittance partner outlets bring financial services closer to more Filipinos.

Financial literacy and empowerment: Through Earnest Learning, our dedicated financial education platform, and community initiatives, we help Filipinos make smarter money decisions. In 2024, financial education programs reached over 58,000 participants across subsidiaries. Campaigns like GIFT and tools like budget trackers promote lifelong financial resilience.