Sustainability

5 MIN READ

Sustainability Highlights

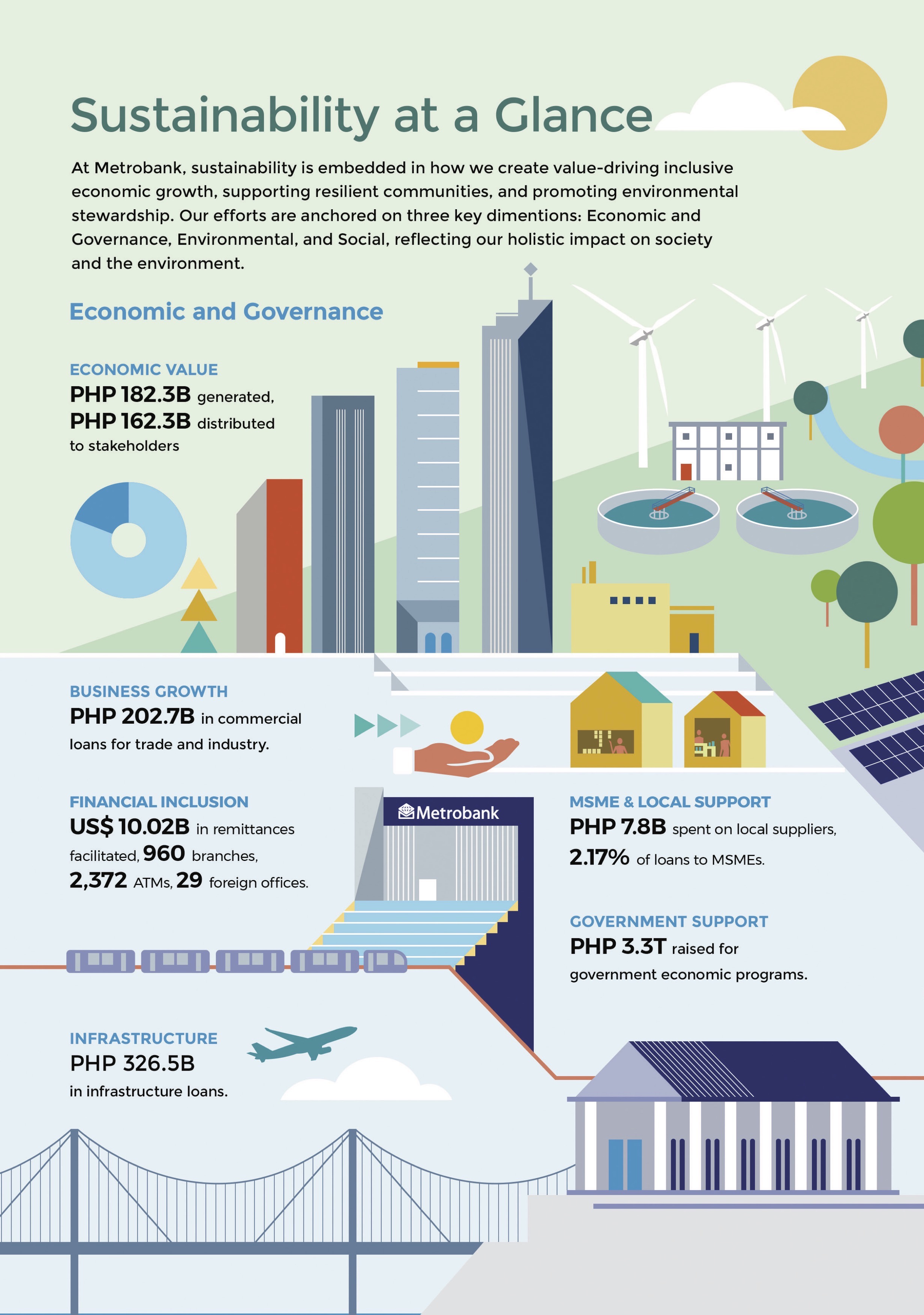

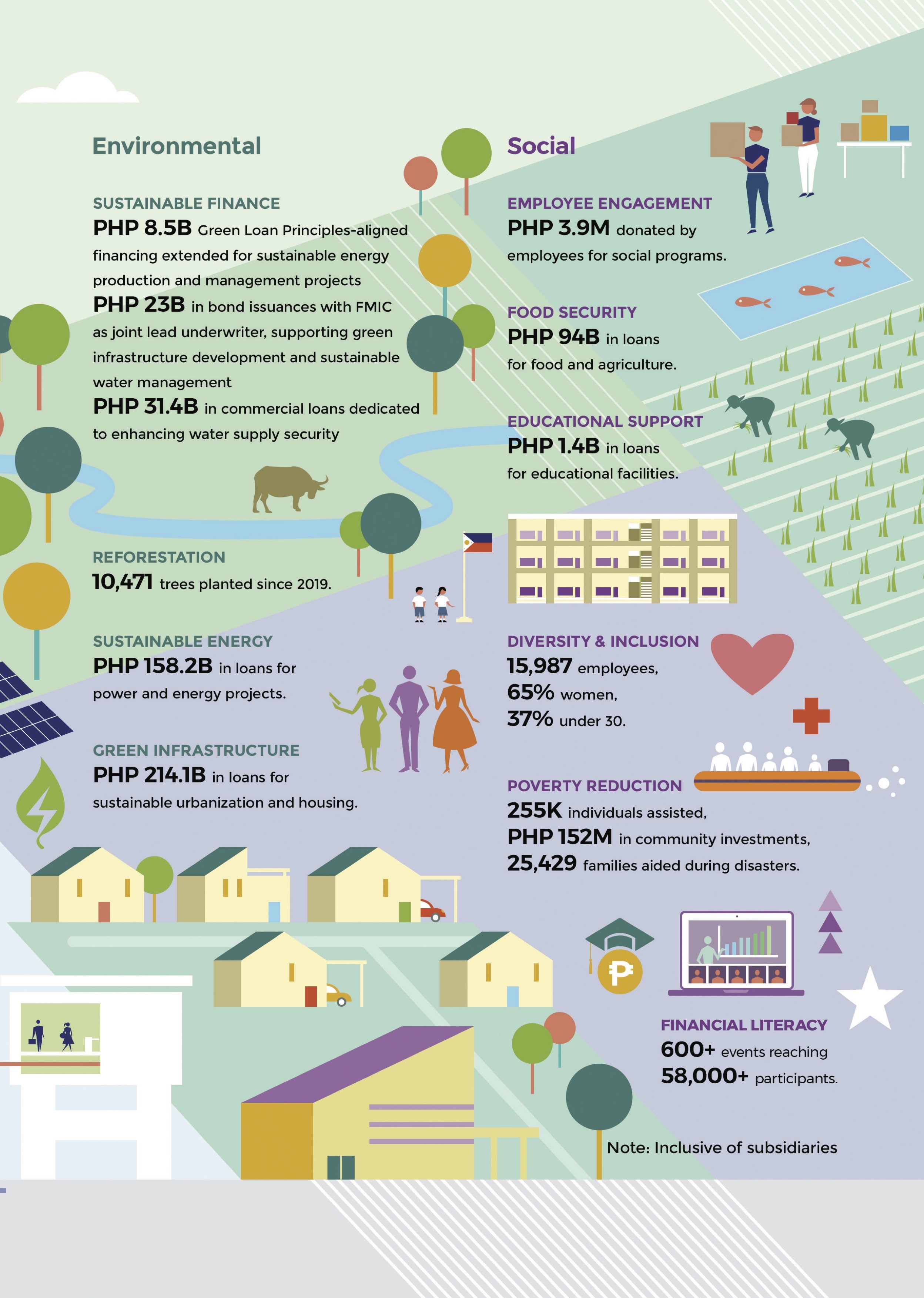

At Metrobank, sustainability is embedded in how we create value—driving inclusive economic growth, supporting resilient communities, and promoting environmental stewardship. Our efforts are anchored on three key dimensions: Economic and Governance, Environmental, and Social, reflecting our holistic impact on society and the environment.

Metrobank drives sustainable growth by allocating resources across economic, environmental, and social sectors. We generated PHP 182.3B in economic value, supporting business growth with PHP 202.7B in commercial loans and facilitating USD 10.02B in remittances. Our environmental focus includes PHP 8.5B in green loans for energy projects, PHP 31.4B in water supply loans, and 10,471 trees planted for reforestation. Socially, we provided PHP 94.0B in loans for food security, PHP 1.4B for education, and PHP 152M in community investments, while promoting diversity and financial literacy through 600+ events reaching over 58,000 participants.

UN SDG Contributions

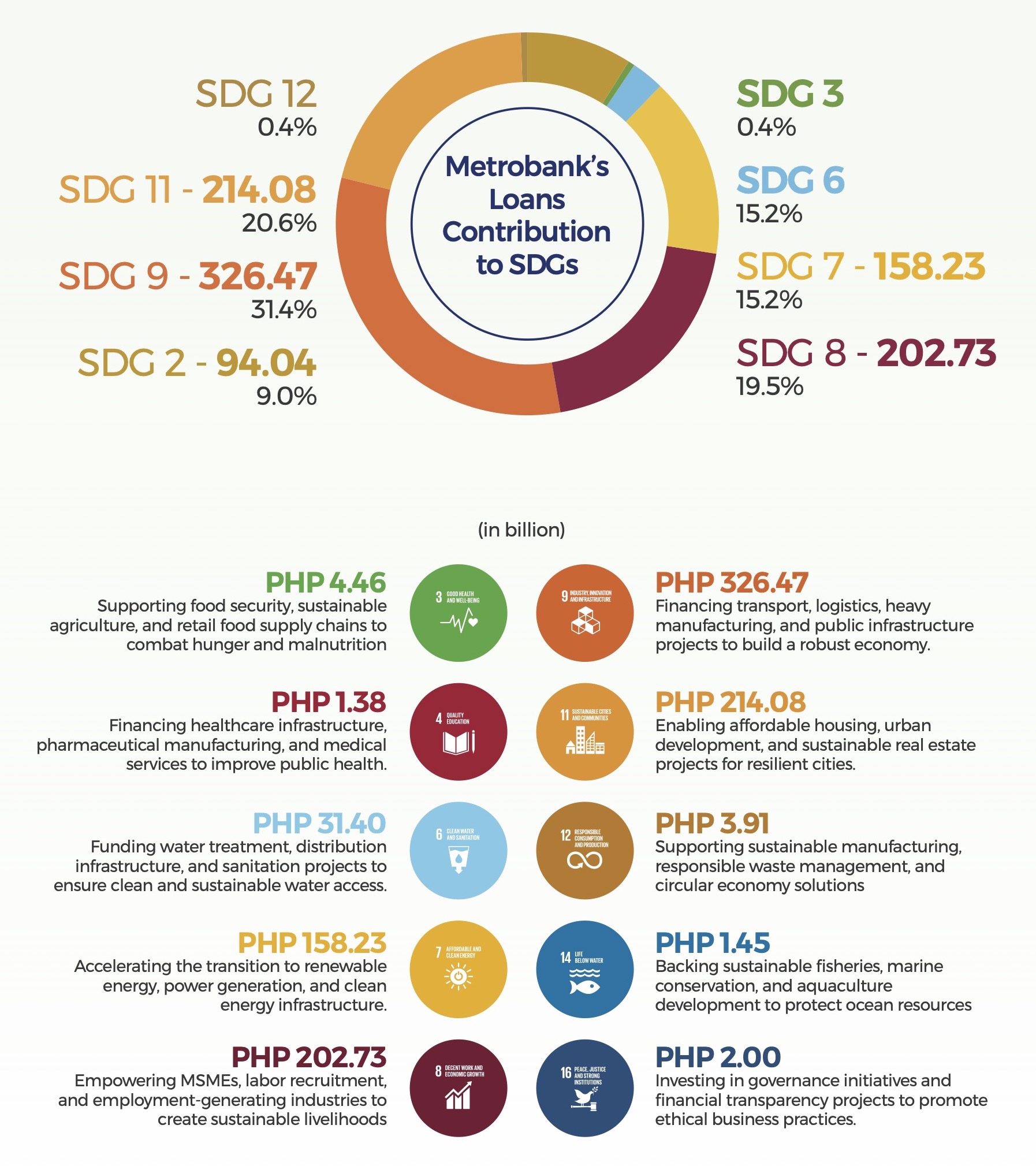

Metrobank’s Loan Contributions to SDGs

Metrobank aligns its lending and investment activities with the UN Sustainable Development Goals to foster inclusive growth, environmental sustainability, and social progress. As of end-2024, 72% of our commercial loan portfolio supports SDG-related projects in food security, clean energy, infrastructure, and financial inclusion. Subsidiaries PSBank and ORIX Metro also contribute by extending agricultural and infrastructure loans to individuals, MSMEs, and enterprises, including those in the countryside.

We prioritize key SDG areas where our financing can create the most meaningful impact, including industry and innovation, sustainable cities, decent work, and affordable clean energy. Our continued efforts reflect a strong commitment to driving national development while addressing global challenges through responsible and inclusive financial solutions.

What Sets Metrobank Apart

We go beyond compliance by integrating environmental, social, and governance (ESG) principles into every aspect of our business, ensuring that our financial decisions contribute to long-term stability, responsible banking, and sustainable progress. Through strong governance, forward-thinking risk management, and strategic investments in sustainability, we continue to lead the way in building a more resilient and inclusive financial system.

This commitment is reflected in how we strengthen sustainability through robust risk governance and controls, advance sustainable finance to support climate action and low-carbon growth, and embed climate resilience into our lending practices to manage environmental and social risks. These efforts reinforce our role in driving positive impact while safeguarding the future of our stakeholders and communities.

Responsible Business Engagement

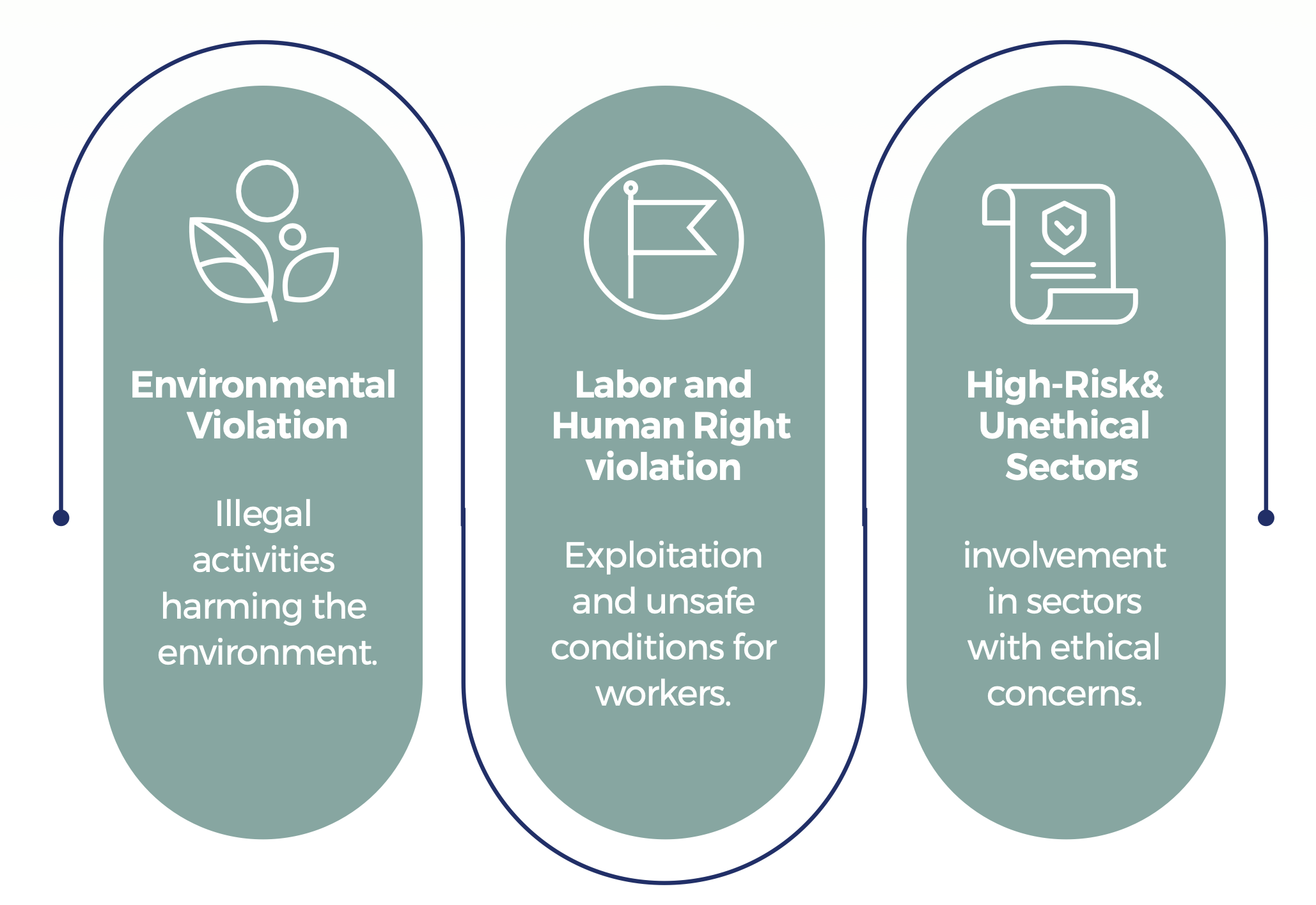

We uphold the highest standards of ethical and responsible banking, ensuring that our financial resources do not contribute to activities that harm communities, ecosystems, or human rights. By enforcing strict exclusion criteria, we protect the integrity of our portfolio while actively promoting sustainable business practices across industries. Our commitment to responsible lending reflects our role in fostering a more inclusive and environmentally responsible economy.

This includes prohibiting financing for activities that illegally harm the environment, such as ecological degradation and pollution; excluding entities involved in labor exploitation or unsafe working conditions that violate human rights; and avoiding sectors with significant ethical, social, or reputational risks. These measures reinforce our dedication to channeling capital only toward ventures that align with our values of sustainability, fairness, and accountability.

Please refer to the Metrobank 2024 Sustainability Report for the Metrobank’s Exclusion List.