5 MIN READ

Economic and Governance

Economic Performance

Metrobank remained resilient amid economic shifts, reaffirming its role in nation-building through inclusive banking, capital mobilization, and support for infrastructure and small businesses. In 2024, the Bank generated PHP 182.3 billion in direct economic value, with PHP 7.8 billion in operational spending supporting local suppliers. We invested PHP 24.4 billion in employee welfare, PHP 27.2 billion in shareholder returns, and PHP 27.7 billion in taxes that funded public services. We also contributed PHP 152 million to community development projects in education, health, and disaster resilience, reflecting our commitment to sustainable growth and positive social impact.

Business Ethics

Metrobank promotes a culture of integrity through strong governance policies and training coverage on anti-corruption practices across employees, management, and business partners. No incidents of corruption or disciplinary actions were recorded in 2024. The Bank’s exemplary governance was recognized with the 4-Golden Arrow Award from the Institute of Corporate Directors, reflecting excellence in ethical leadership and accountability.

Systemic Risk Management

We manage environmental and social risks through our enterprise risk management frameworks, integrating climate and sustainability into our business strategy. Oversight by the Board and risk committees ensures ESG due diligence, climate adaptation, and responsible credit policies for long-term resilience.

We follow key regulations such as BSP Circulars 1085, 1128, and 1149, the Sustainable Finance Taxonomy, and SEC rules. Strict due diligence, risk scorecards, and exclusion lists guide lending and investment decisions. High-risk borrowers are monitored, and environmental and social checks are part of our operational risk processes, including business continuity and disaster planning.

Our strategy is built on three principles: Do No Harm, Do Good, and Do More. We reduce harmful exposure, support the low-carbon transition, and increase green financing.

Our Board’s Role in Driving Sustainability

Our Board of Directors, through the Executive Committee and Risk Oversight Committee, sets sustainability objectives covering short-, medium-, and long-term horizons, aligns environmental and social risks with enterprise risk strategies, integrates mitigation into credit, investment, and operations, and upholds strong governance and regulatory compliance.

How We Put Strategy Into Action

Our senior management, supported by the Sustainability Department, implements our sustainability objectives covering short-, medium-, and long-term horizons, applying the Environmental and Social Risk Management framework, integrating sustainability into credit, investment, and operations, and reviewing policies to guide strategy.

Identifying and Monitoring Sustainability Risks

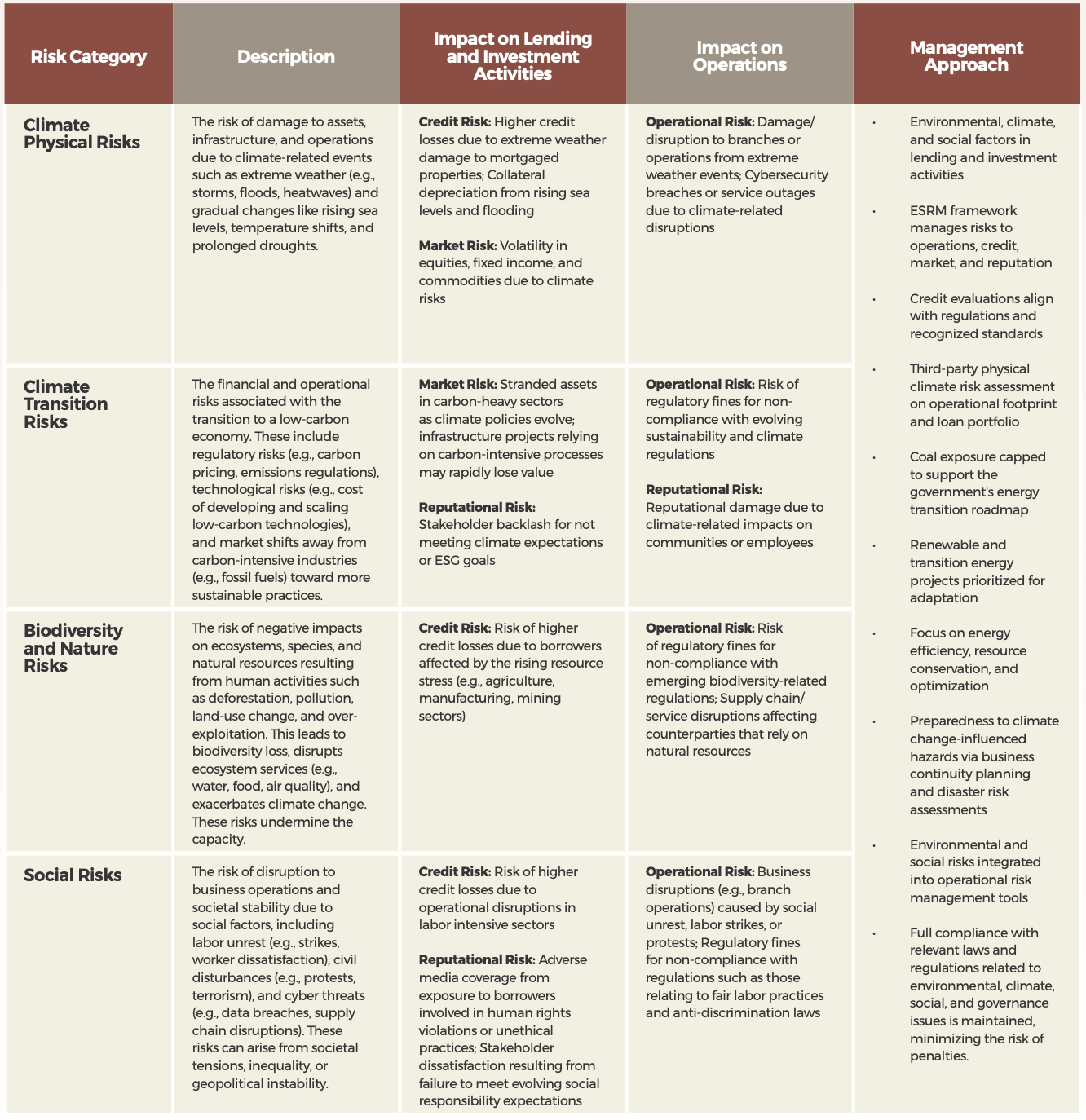

Metrobank identifies, assesses, and monitors environmental and social risks across lending, investment, and operations to stay resilient amid evolving climate challenges. Unmanaged E&S risks can heighten credit, market, operational, and reputational risks, impacting financial performance and stakeholder trust.

We address these risks by embedding E&S considerations into enterprise-wide risk management, applying assessment tools, ensuring regulatory compliance, and integrating sustainability into credit and operational evaluations. To enhance oversight, we engaged a third-party consultant to assess climate-related risks in our operations and loan portfolio. The assessment revealed key vulnerabilities, strengthened resilience planning, and advanced the integration of climate risk into financial decision-making.

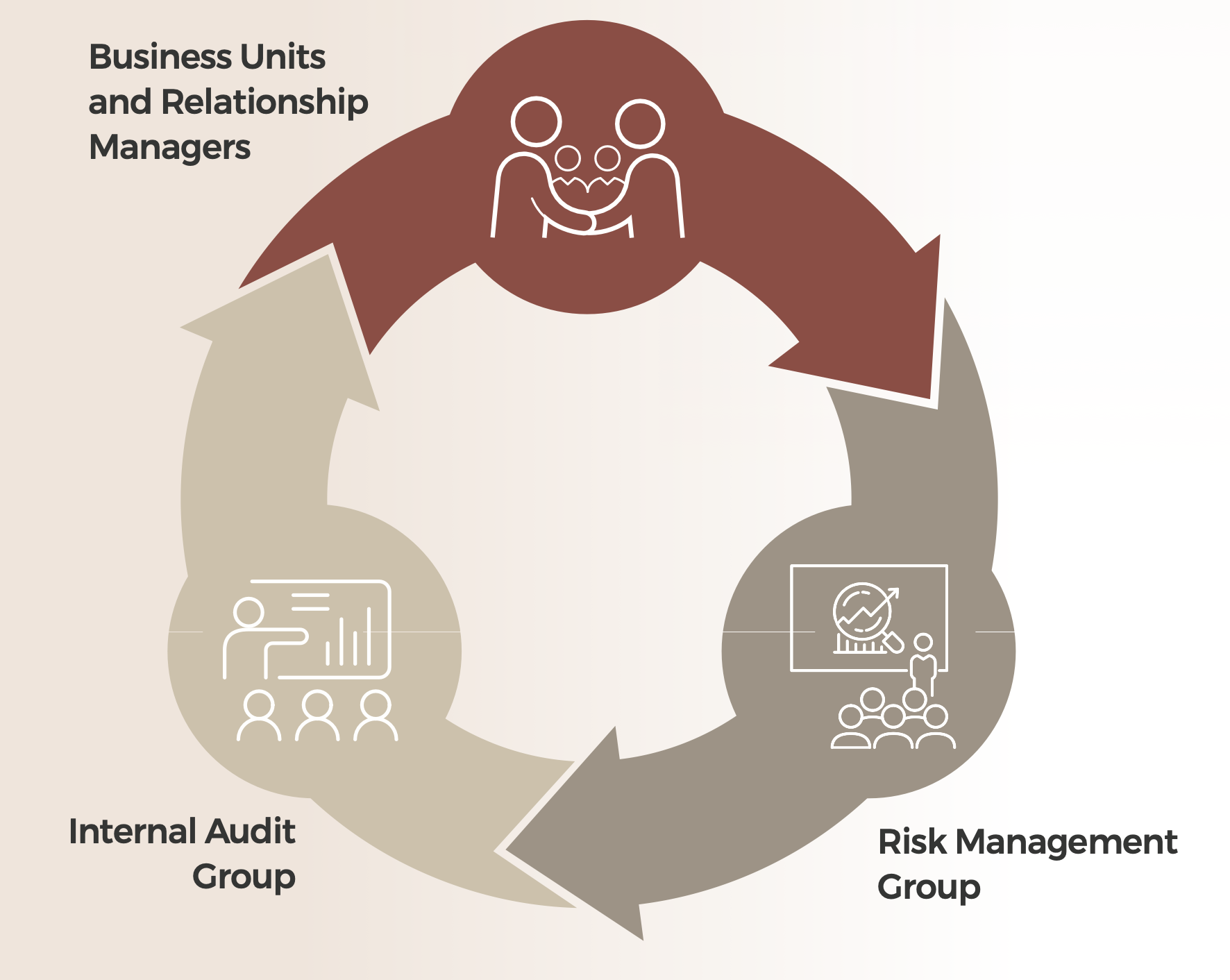

Three-Lines-of-Defense in E&S Risk Management

Business units and relationship managers conduct initial screening of counterparties to ensure alignment with Metrobank's sustainability agenda.

The Risk Management Group oversees emerging risks, provides independent control, and integrates climate risks into enterprise risk management.

Internal Audit group reviews the effectiveness of sustainability risk governance, ensuring compliance and adaptability to climate risks, regulations and best practices.

Staying Ahead of Emerging Environmental and Social Risks

In a rapidly evolving sustainability landscape, Metrobank remains proactive in identifying and managing emerging environmental and social risks. Through our strengthened ESRM framework, we integrate climate, nature, and social risk considerations into our lending, investment, and operational decisions. This allows us to protect our business, align with regulatory expectations, and support the transition to a more resilient and sustainable economy.

Business Model Resilience and Innovation

Our resilience is built on continuous innovation and digital transformation. In 2024, we focused on enhancing client experiences through streamlined digital processes, strategic partnerships, and strengthened risk frameworks. These initiatives reflect our proactive approach to managing risks, seizing opportunities, and sustaining stakeholder trust in a rapidly evolving economic and climate environment.

A key milestone was the modernization of our wealth management platform in partnership with Collaboration Betters The World (CBTW). Through the launch of Temenos Wealth, we introduced AI-powered analytics, robo-advisory tools, and goal-based planning features to deliver more personalized service to our High Net Worth (HNW) and Ultra High Net Worth (UHNW) clients. With its API-driven architecture and seamless integration with third-party applications, the platform enhances efficiency, reduces risk, and reinforces our position as a trusted, future-ready financial partner.

Supply Chain Management

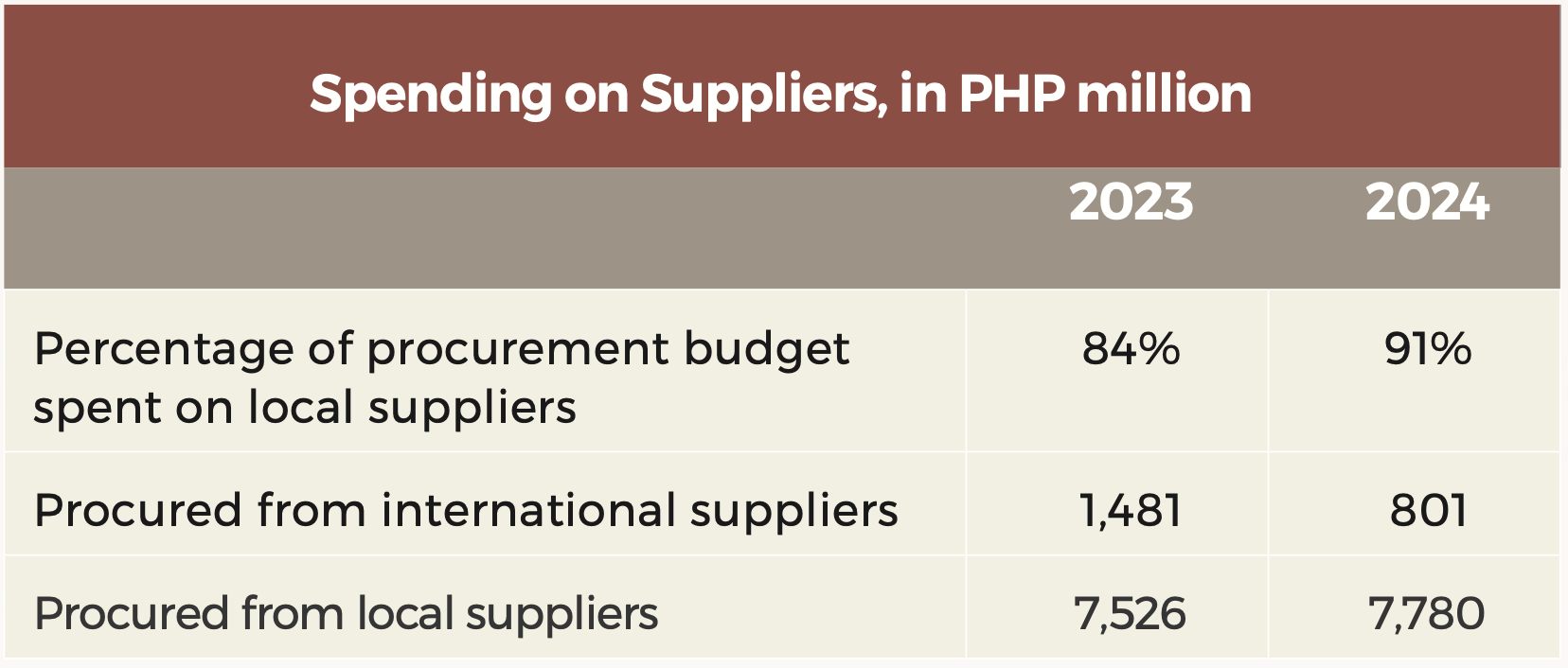

Ethical sourcing, regulatory compliance, and sustainability are at the core of our procurement practices. Supplier accreditation follows BSP guidelines to ensure adherence to legal and ethical standards. We continue to strengthen relationships with local vendors, contributing to domestic economic growth. In 2024, 91% of our procurement budget was allocated to local suppliers, up from 84% in 2023.

ESG Considerations in Products and Services

We embed ESG principles across our lending, investment, and service offerings to support sustainable development and create long-term value. From green loans to sustainability-linked bonds and inclusive financial products, our portfolio is designed to deliver both economic returns and positive societal impact.

Retail:

Cards: We offer solar panel installation promotions to both employees and cardholders, encouraging renewable energy adoption and reducing carbon footprints.

Fairtech Solar Partnership: We collaborate with Fairtech Solar to provide cardholders up to six free solar panels, reducing traditional energy reliance and lowering power bills.

Commercial:

Green Loans: We finance projects that offer clear environmental benefits—supporting renewable energy, energy efficiency, sustainable agriculture, and eco‑friendly infrastructure.

Exclusion List: We maintain a strict exclusion list to avoid financing activities that harm the environment, society, or governance integrity.

These initiatives reflect our commitment to integrating ESG in every aspect of our business, supporting a more sustainable and inclusive future for all stakeholders.