Risk and Crisis Management

Building a strong bank takes exceptional commitment in managing risks. Metrobank has been in the banking business for the past 59 years, and the success of its enterprise reflects how it responsibly safeguards the financial resources stakeholders entrust in the Bank. It only takes on risks that it understands, can manage, mitigate, or accept. It conducts its business based on a risk management framework suited to its scope and complexity, consistent with international regulatory standards.

Risk Management Principles

Balancing risk and reward translates to the following risk management principles:

- The Bank manages risks that correspond to its goals and objectives as an ongoing business.

- The Bank’s risk management practices must continue to be relevant and practicable, but always aligned with standards set by its regulators.

- The Bank must ensure that it has the right governance structure to mitigate risks and avoid losses while maximizing gains that may accrue from business opportunities.

- Risk management is everyone’s concern–from the Board who sets the overall tone, to the officers and staff who execute the Bank’s risk management strategy.

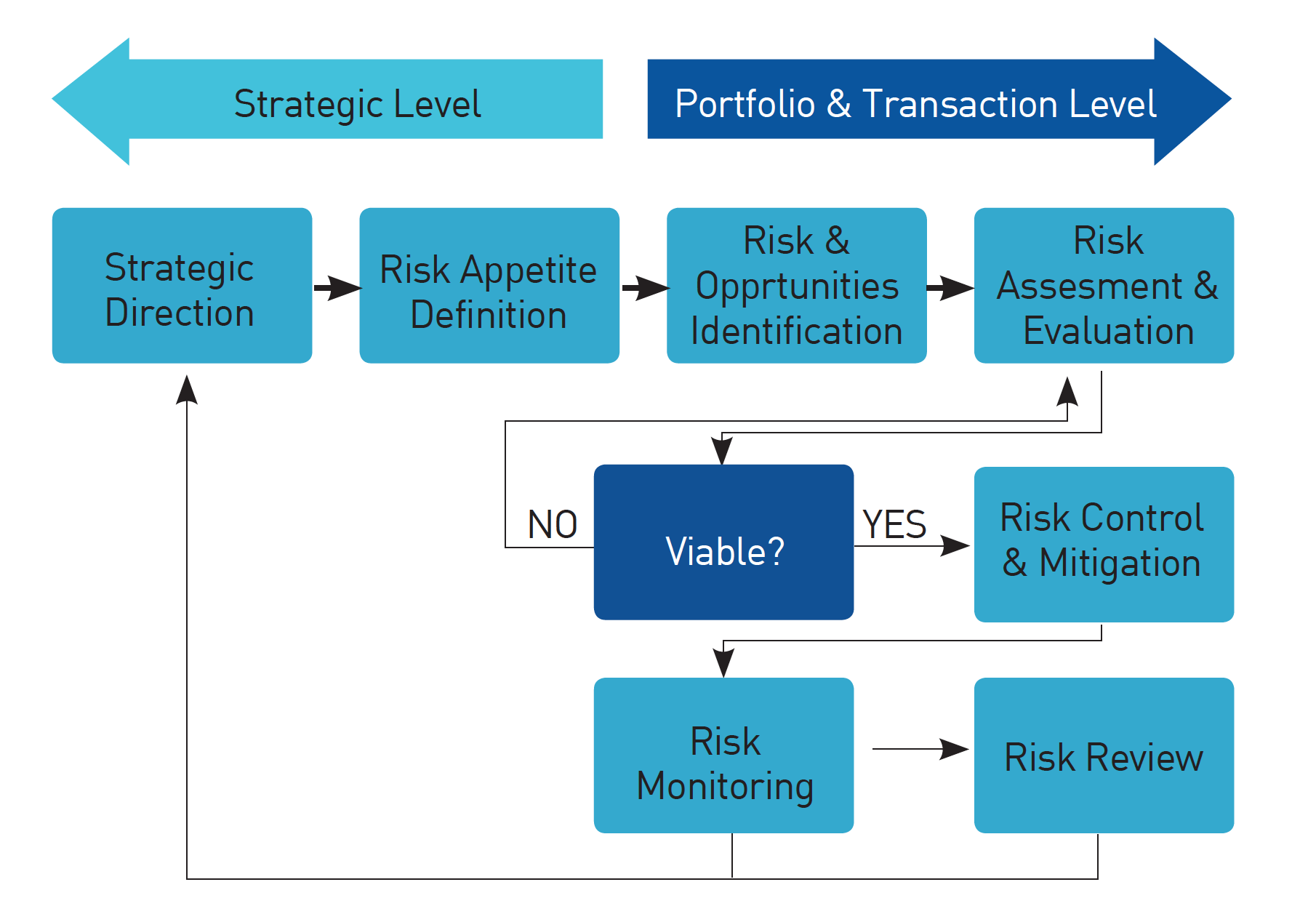

Risk Management Process

Metrobank’s robust risk management process entails the determination of its strategic goals, material risks, and appetite for such risks. By identifying, measuring, managing, and monitoring risks, financial resources are properly allocated, and capital adequacy is continuously assured.

Risk Governance

The Board of Directors, through the Risk Oversight Committee (ROC), composed primarily of independent members of the Board, plays an active role in setting the Bank’s risk culture and overseeing the risk infrastructure, operating policies, and exposures to ensure a good balance between risk appetite and prudence.

The Risk Management Group (RSK) supports and reports directly to the ROC. RSK is an independent unit of the Bank that identifies, analyzes, measures, and monitors identified material risks in close coordination with other business units. It exercises oversight on the risk management units of various subsidiaries and affiliates.