Material Risks

As a Domestic Systemically Important Bank (DSIB), Metrobank faces a broad range of risks reflecting its status. These risks include those resulting from its lending activity, treasury operations, and extensive client-facing network, including its branches.

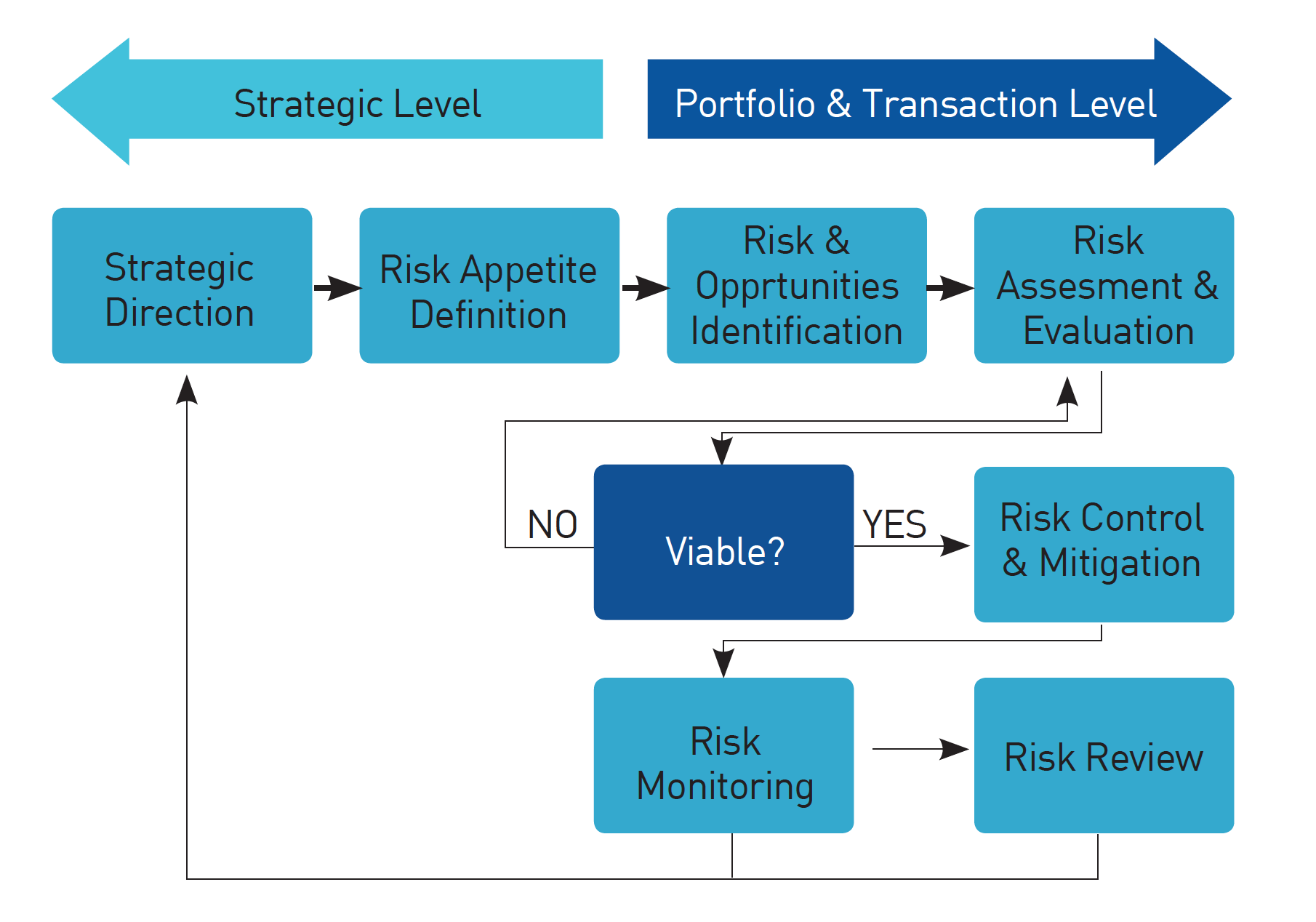

The Bank recognizes that it is not possible or necessarily desirable to eliminate some of the risks inherent in its activities. Acceptance of some risk, therefore, is often necessary to foster growth and efficiency within business practices. At all times, however, the Bank ensures that any risk-taking activity is aligned with its corporate objectives and capabilities, and that an effective risk management process is in place.

The following are some of the material risks the Bank faces and the strategies for managing these.

Credit Risk

This is the risk that the borrower, issuer, or counterparty in a transaction may default and cause potential loss to the Bank. It arises from lending, trade finance, treasury, derivatives, and other similar activities.

The Bank’s appetite for this risk is low to moderate, reflective of its core business and the social responsibility that comes with being one of the financial system’s largest lenders. As a matter of general strategy, the Bank manages this risk through a system of policies, metrics, and authorities that govern the processes and practices of all credit-originating and relationship management units, as well as other units involved in the credit cycle.

Credit Concentration Risk

This is the current and prospective negative impact to earnings and capital arising from over-exposure to specific industries and/or borrowers/ counterparties.

The Bank has a moderate appetite for this risk, recognizing that specific growth areas may need credit support more than others, and that lending to highly integrated customers often leads to pockets of concentration.

The Bank manages this risk via adherence to processes relating to industry and counterparty assessments, observance of regulatory ceilings, and setting of internal limits.

Market Risk

This is the risk resulting from adverse movements in the general level or volatility of market rates or prices or commodity/equity prices possibly affecting the Bank’s financial condition.

Senior Management, through the Asset and Liabilities Committee (ALCO), sets a general business model for its trading portfolio based on macroeconomic conditions, financial markets trends, possible events/regulations, and the risk appetite set by the Board. This is implemented by the Financial Markets Sector which originates transactions and/or crafts new products needed by clients, while keeping itself updated on the financial environment and working within set limits and policies.

The Bank’s appetite for this risk is low, and manages this risk via a process of identifying, analyzing, measuring, and controlling relevant market risk factors, and establishing appropriate limits for the various products and exposures.

Interest Rate Risk in the Banking Book (IRRBB)

The Interest Rate Risk in the Banking Book (IRRBB) is the current and prospective negative impact to earnings and capital arising from movements or shifts in interest rates. The risk becomes inherent in the current and prospective interest gapping of the Bank’s balance sheet, as the Bank’s core business involves intermediation activities such as deposit-taking and lending that inadvertently creates both maturity and rate mismatches.

The appetite for this risk is low; as such, the Bank follows a set of policies on managing its assets and liabilities to ensure that exposure to interest rate fluctuations are kept within acceptable limits. This appetite is translated into a set of limits, a major tool in monitoring and controlling the degree of interest rate risk that the banking book is exposed to at any given point in time. Limits include Earnings-at-Risk (NII-at-Risk) limit and management action trigger (MAT), Delta Economic Value of Equity (ΔEVE) limit, FVOCI MtM loss trigger, position limits, and tenor limits.

Liquidity Risk

This is the risk to earnings or capital arising from the Bank’s inability to meet its obligations when they become due. The Bank considers liquidity risk as the most important considering that liquidity is the lifeline of any bank. As such, the appetite for liquidity risk is low. The Bank’s strategy for managing this risk is generally via limiting the maturity mismatch between assets and liabilities, improving the stickiness of its deposit and liabilities profile, and by holding sufficient liquid assets of appropriate quality and marketability.

Operational Risk

This is the risk arising from the potential that inadequate information system, operations, or transactional problems (related to service or product delivery), breaches in internal controls, fraud or unforeseen catastrophes will result in unexpected loss.

The Bank’s appetite for operational risk is low and is managed via a framework involving various tools that promote a strong control environment, escalation, monitoring and reporting of risk events, and adequate mitigation of assessed risks.

Technology Risk

This is the current and prospective negative impact to earnings arising from failure of the Bank’s IT systems, including information and cybersecurity. The Bank’s appetite for IT risk is low, and its strategy in managing this risk is embodied in comprehensive information technology, Information Security and IT risk management policies.

Reputational Risk

This is the current and prospective negative impact to earnings and capital arising from negative public opinion. As a bank essentially survives on its reputation, the Bank has very low appetite for reputational risk and always aims to proactively build on its good name. It considers reputational risk because of other risks.

In line with BSP Circular No. 1114 on Reputational Risk, the Bank adopts as part of its enterprise risk management system, a Reputational Risk Management Framework covering the Metrobank Group.

Compliance and Regulatory Risk

This is the current and prospective negative impact to earnings and capital arising from failure to comply with all applicable laws, regulations, and standards of good governance and practice. The appetite for this risk is low and is managed via the conduct of a defined Compliance program. Specific to Money Laundering & Terrorist Financing (ML/TF) Risk, the Bank has zero tolerance for the same, and is managed separately by the Bank’s Anti-Money Laundering Division (AMLD) reporting directly to the Board’s AML Committee.

Strategic Risk

This is the current and prospective negative impact to earnings arising from adverse business decisions, improper implementation of decisions, and/or lack of responsiveness to industry changes. The Bank’s strategy in managing this risk is to embed the same in the various business functions as espoused in its strategic and business planning processes.

Contagion Risk

This is the risk that the financial difficulties encountered by a member of the conglomerate could impact the financial stability of the rest of the members or the entire group. To mitigate this risk, the Bank places importance on policies, limits structures, and monitoring of controls in dealing with RPTs, DOSRIs, and SAAs.

Risk Reporting

To ensure that exposures are within the Board-approved risk appetite, and that management can lead the Bank to the fulfillment of its strategies and targets while within acceptable risk ranges, RSK and specialized Bank units report the following risks outlined below to both management and Board.

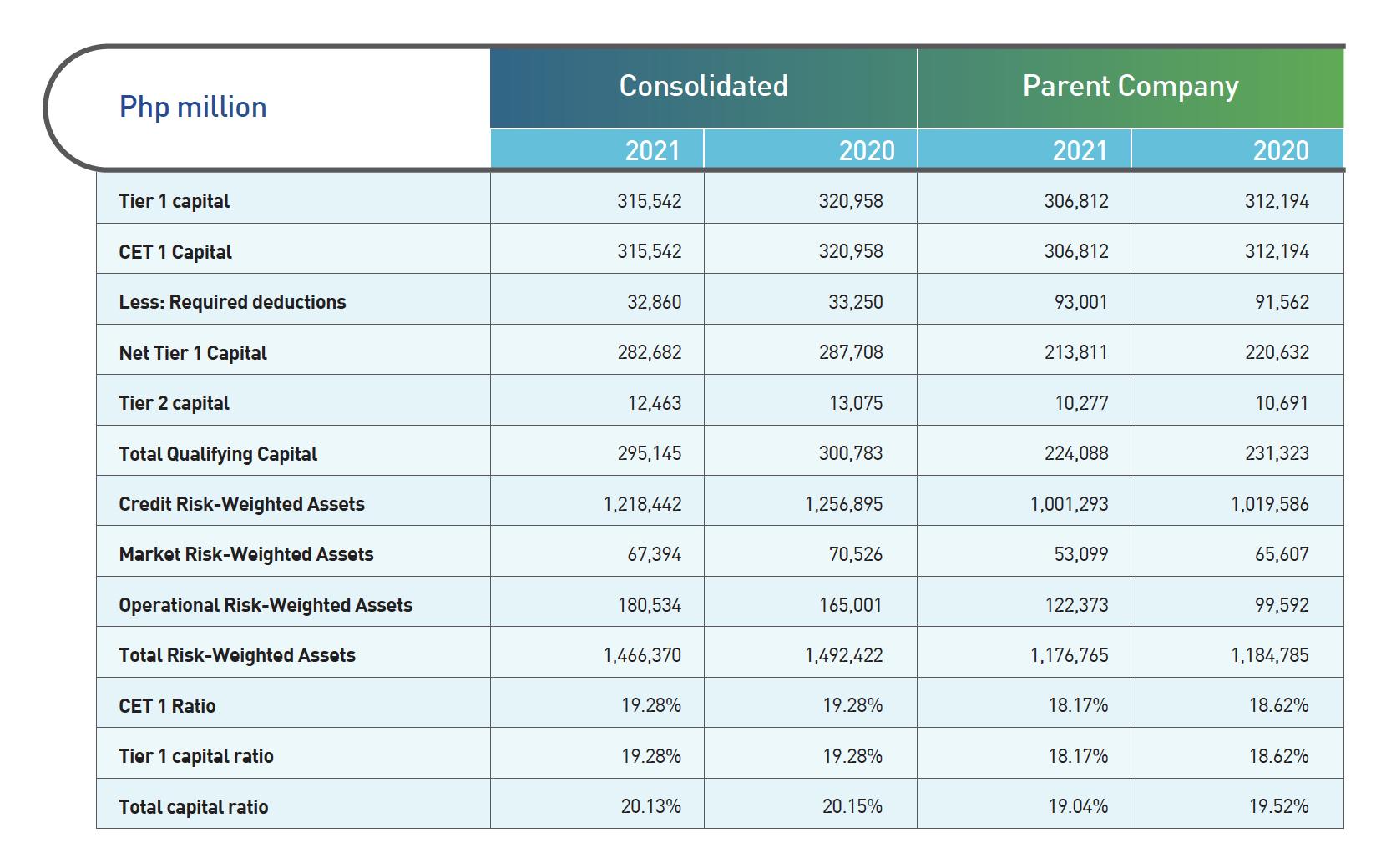

Capital Adequacy

The primary objectives of the Bank’s capital management process are two-pronged: to ensure that, on per entity and consolidated bases, it complies with regulatory capital requirements; and to maintain strong credit ratings and healthy capital ratios to support its business and to maximize shareholders’ value.

The Bank’s capital planning starts with a Strategic Plan, where its strategic themes, goals and objectives are set. Following this is Financial Forecasting where goals and objectives are translated into financial forecasts (i.e., Balance Sheet, Income Statement, Interest Rate, and Regulatory Capital). The third is Risk and Capital Assessment. From the forecast, solutions to issues on capital are explored. These include capital raising and other measures to optimize profitability and capital efficiency.

Risk Management in the Time of COVID-19

We have built up our experience in managing emerging and heightened risks amidst the continuing COVID-19 pandemic. Through our Business The Bank has built up its experience in managing emerging and heightened risks amidst the continuing COVID-19 pandemic.

The lessons and insights gathered through its Business Continuity Plan (BCP) Operability Assessment on WHAT-WENT-WELL and WHAT-WENT-WRONG during the earlier part of the pandemic in 2020 has served as its cornerstone in developing more robust business continuity strategies, plans and processes to ensure that the flow of financial activity remains uninterrupted and critical business operations were continued while putting the safety of its employees ahead.