Zero Annual Fees Forever

Use your Metrobank credit card this holiday season and enjoy lifetime annual fee savings.

Promo Mechanics

-

The 2025 Metrobank Zero Annual Fees Forever Promo (“Promo”) shall run from December 1 to December 31, 2025 (“Promo Period”) only.

-

The promo is exclusive to pre-selected Metrobank Peso Visa/Mastercard, Metrobank Vantage Visa/Mastercard, Titanium Mastercard, Platinum Mastercard, World Mastercard, NCCC Mastercard, Toyota Mastercard, Robinsons Mastercard, Rewards Plus Visa, Femme Visa, Femme Signature Visa, Cashback Platinum Visa, Travel Platinum Visa, and Travel Signature Visa cardholders in good credit standing who received the promo SMS/Viber message or e-mail blast from Metrobank only. The promo is not applicable to Mfree Mastercard, PSBank Credit Mastercard, Corporate Mastercard, ON Mastercard, Dollar Mastercard, Dealer Financing, Metrobank PRIME, Elite, Premier + Debit, Prepaid cards.

-

The pre-selected customers will receive an EDM/SMS/Viber with a reference number from Metrobank. Metrobank will not accommodate the request of the cardholder to include his or her account in the list of pre-selected customers for the Promo.

-

Cardholders must use their card for any retail, online or installment transaction from December 1, 2025 up until December 31, 2025 to be eligible to the incentive.

-

The principal cardholder’s annual fee will be waived for life if the cardholder reaches the required minimum accumulated valid spend from December 1 – 31, 2025:

Product Type Min. Spend within Promo Period World Mastercard, Travel Signature Visa Accumulated spend of PHP 70,000 Platinum Mastercard, Travel Platinum Visa,

Femme Signature VisaAccumulated spend of PHP 50,000 Titanium Mastercard, Toyota Mastercard,

Rewards Plus Visa, Cashback Visa, Femme Visa,

Vantage Visa/Mastercard, and all other credit cards

not mentioned in this tableAccumulated spend of PHP 30,000 -

If the principal cardholder does not meet the required spend, he/she will be charged an annual fee. The corresponding annual fee will be reflected on the Cardholder’s statement of account after the anniversary date.

-

Annual fees which were charged before the Promo Period shall not be reversed even if the cardholder met the spend requirement during the Promo Period. The free-for-life annual fee waiver will only apply after the Promo Period.

-

Valid spend in the accumulated spend computation shall only include the following posted transactions below:

a. Straight retail transactions

b. Online transactions

c. Bills2Pay or Paybills

d. Retail Installments & Special Installments (Balance Transfer & Cash2Go only)

e. Valid transactions made by supplementary cardholders will be included in the computation of the principal cardholder’s accumulated spend

-

The following transactions and fees will not be considered as valid spend:

a. Add-on interest

b. Fees and charges

c. Cash Advance

d. PayNow

e. Balance Conversion installments

f. The transactions with credit adjustments resulting from merchant-initiated credit adjustments and transaction disputes

g. Other transactions such as online fund transfers charged to the credit card, transactions with merchant category codes of 6540 (stored value card purchases such as but not limited to Lazada Top Up, Maya Cash In, ShopeePay Cash In, GrabPay Cash In), 6010 (cash advances), 6011 (ATM transactions) and 6012 (other financial institution merchandise excluding Bills2Pay, Paybills, Balance Transfer and Cash2Go) found in Metrobank’s database.

-

Only the principal cardholder can qualify for the Promo. The annual fee of supplementary cardholders will not be waived under this Promo even if the principal cardholder meets the spend requirement.

-

The Annual Fee Waiver is non-transferable, and cannot be converted or exchanged for cash, credit, benefit, advantage, or any property.

-

The computation of the accumulated spend and awarding of the free-for-life annual fee waiver to cardholders by Metrobank is considered final.

-

In the event that the cardholder requests for an upgrade, conversion, or any change to the qualified credit card at any time, the Annual Fee Waiver under this Promo will no longer apply. The Annual Fee Waiver is non-transferable and will not be carried over to the newly upgraded, converted, or changed credit card.

-

Metrobank reserves the right to disqualify any cardholder from further participation in this Promo if the cardholder has past due accounts with Metrobank, defaults in his/her payment or, if in Metrobank’s judgment, the said cardholder has violated these Terms & Conditions and/or the Metrobank Credit Card Terms and Conditions.

-

Metrobank reserves the right to disqualify a previously approved transaction that was cancelled or charged back within the Promo Period. Should a cardholder receive the Annual Fee Waiver, but was later on deemed unqualified for not meeting the requirements of the incentive due to disputes arising from, but not limited to, erroneous, invalid, fraudulent or unauthorized transactions, the cost of the annual fee shall be charged by Metrobank to the cardholder’s credit card account upon the anniversary date of the card.

-

Employees of Metrobank are disqualified to join this Promo.

-

All questions or disputes regarding the cardholder’s eligibility for the Promo or for any redemption shall be resolved by Metrobank, at its discretion, with the concurrence of the DTI.

-

Any dispute concerning the products or services availed to meet the spend requirement shall be settled directly between the cardholder and the appropriate merchant with the concurrence of the DTI.

-

The use of the Metrobank credit card in connection with the Promo is subject to the Metrobank Credit Card Terms and Conditions.

-

By joining or availing of this Promo, the Cardholder confirms that he/she has read, understood and agreed to the promo mechanics and these Terms and Conditions.

-

For inquiries and other concerns, contact the Metrobank Customer Service Hotline at (02) 88-700-700 or send an e-mail to customerservice@metrobankcard.com

Metrobank is regulated by the Bangko Sentral ng Pilipinas (https://www.bsp.gov.ph)

METROBANK CREDIT CARDS

Eligible Cards

The following cards are eligible for the promo.

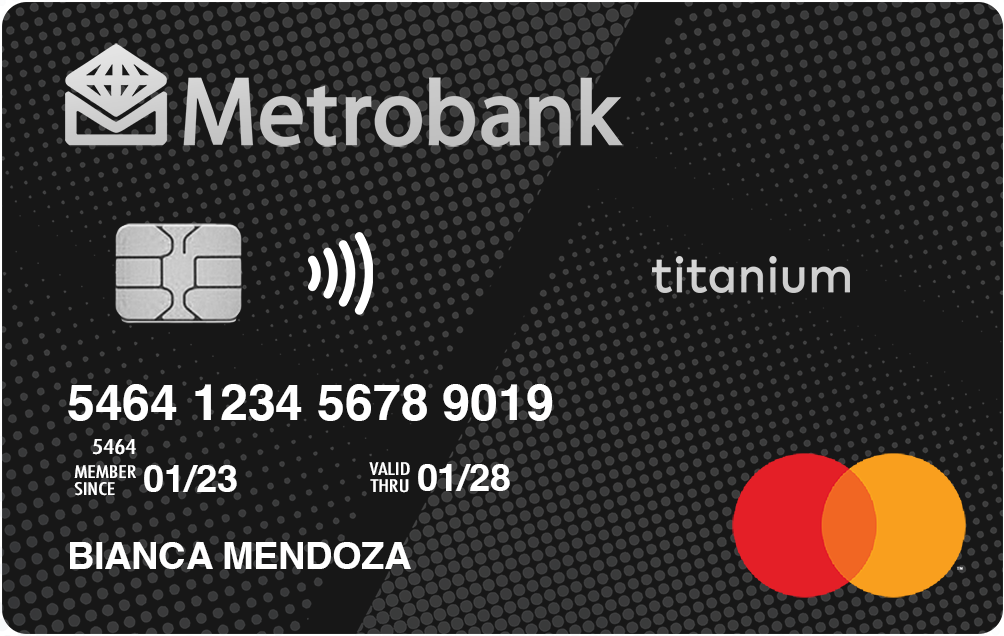

Titanium Mastercard

Platinum Mastercard

Toyota Mastercard

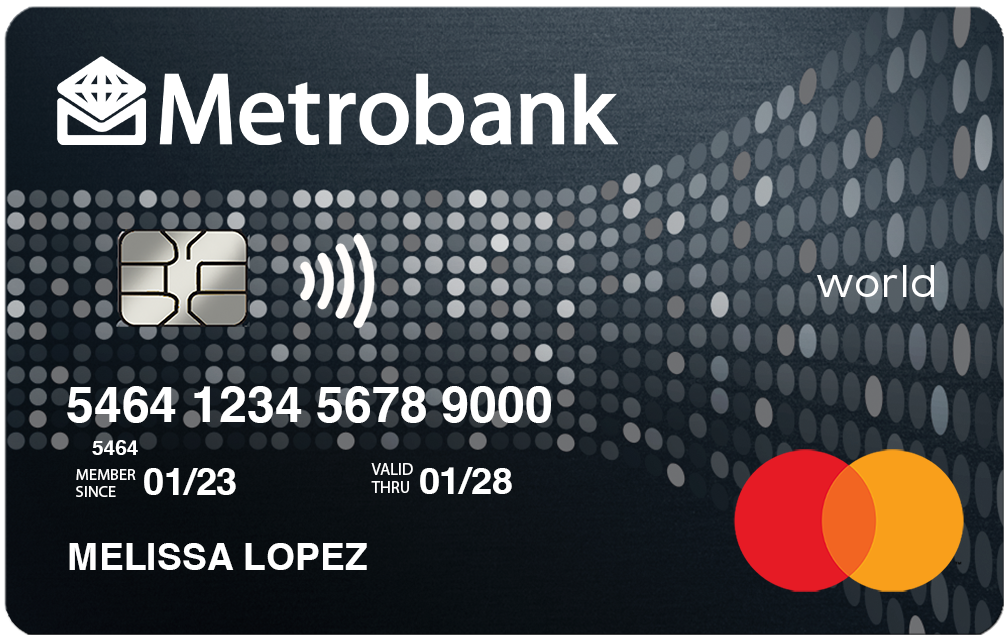

World Mastercard

Travel Signature Visa

Rewards Plus Visa

Cashback Visa

Travel Platinum Visa

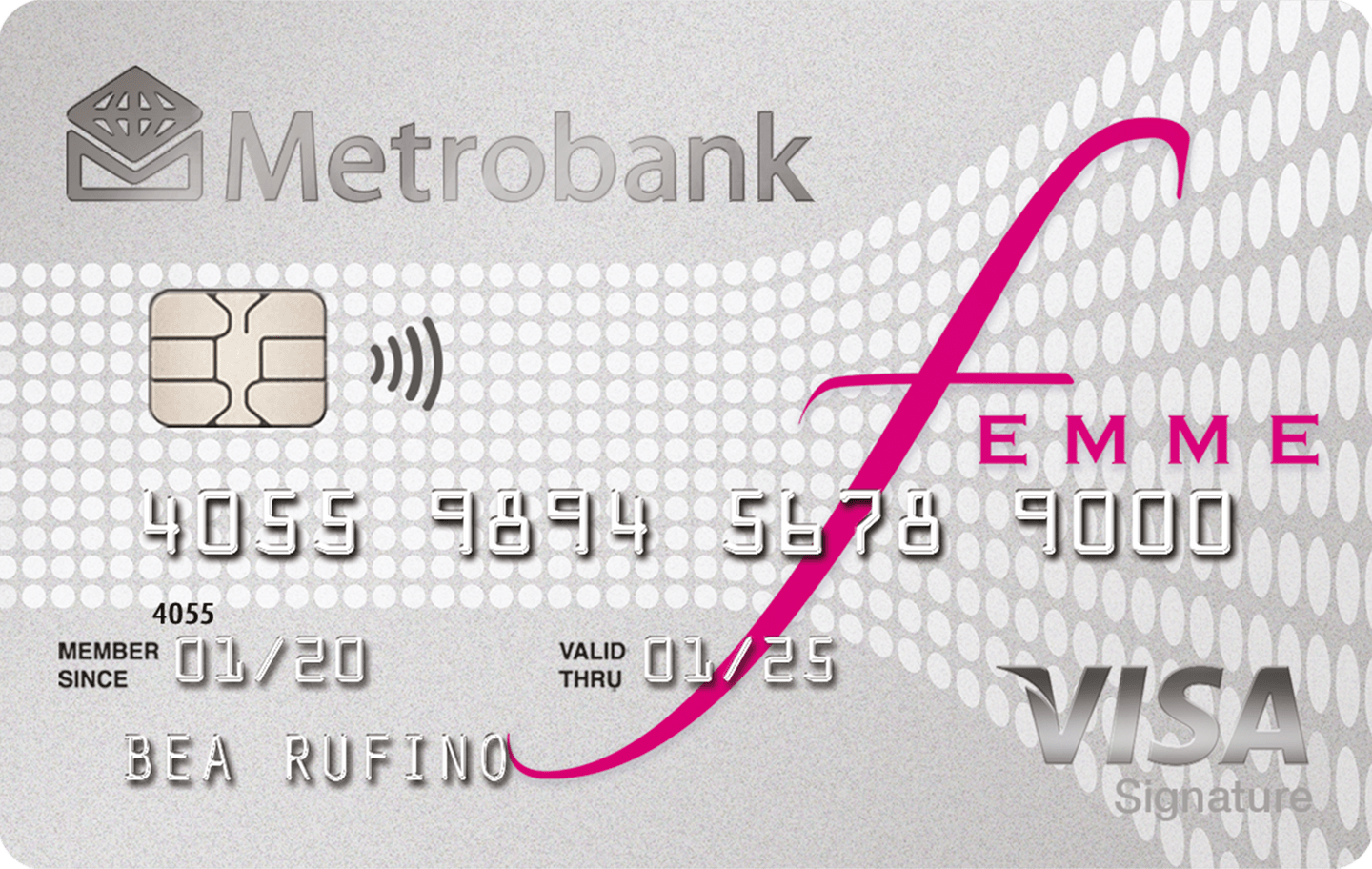

Femme Signature Visa

Terms & Conditions

Standard Terms and Conditions apply.

Your data is in good hands. Metrobank is committed to protecting your privacy under the Data Privacy Act of 2012. We will collect and process your personal data, such as your first name, mobile number, email address, and the last four (4) digits of your account number, only to qualify you for the “Master Your Wealth Campaign,” in line with our Privacy Policy.

Your data will be kept for the duration of one (1) year from the promo period. This Privacy Notice may be updated as needed; we'll inform you via email. Please check this page periodically for updates.

Per DTI Fair Trade Permit No. FTEB-243881, Series of 2025. Promo Reference No. CCPD25-478