Metrobank recognizes the critical role of the financial sector in supporting the Philippines’ transition toward a resilient, inclusive, and sustainable economy. As a leading universal bank, Metrobank integrates sustainability considerations into its core business strategy, risk management, and financing activities. Sustainable Finance is embedded in how the Bank allocates capital, manages environmental and social risks, and supports national development policies.

Metrobank’s Sustainable Finance Framework (the “Framework”) establishes a structured and transparent basis for the issuance of green, social, and sustainability financing instruments. The Framework defines how proceeds are allocated exclusively to eligible projects that deliver clear environmental or social benefits, while maintaining established governance policies, risk discipline, and disclosure practices.

Sustainability Principles

Metrobank’s sustainable finance activities are guided by three core principles that underpin its approach to responsible banking:

DO NO HARM:

Rationalize exposure to identified closely monitored industries/sectors due to potential environmental and social impact.

- Plan for the gradual wind-down of exposure to environmentally and socially harmful activities.

- Align with government goals towards exposure targets for identified closely monitored industries/sectors.

DO GOOD:

Support transition finance for hard-to-abate sectors

- Consider the provision of transition finance to borrowers to support their sustainability journey.

- Identify high environmental and social risk clients that require enhanced due diligence and create a roadmap to reduce high-risk exposure.

DO MORE :

Accelerate the growth of a sustainable portfolio

- Identify and assess opportunities for growth of a sustainable loan book

- Where applicable, strengthen the sustainable products portfolio.

These principles guide decision-making across the Bank’s sustainable finance activities and are embedded within its broader risk management framework.

Governance and Risk Management

Oversight of sustainable finance is embedded within Metrobank’s governance and enterprise risk management structures. The Board of Directors, through its relevant committees, provides oversight of sustainability-related risks and ensures alignment with regulatory requirements and the Bank’s strategic objectives. Senior management is responsible for implementing the Framework, supported by the Sustainability Department and relevant business and control units.

The Framework is supported by Metrobank’s Environmental and Social Risk Management Framework, which ensures that material environmental and social risks are identified, assessed, and managed across lending, investment, and operational activities. All sustainable finance transactions are subject to internal credit processes, due diligence, and continuous monitoring. Explicit exclusion criteria apply to ensure that proceeds are not used for activities that may cause material environmental or social harm.

Sustainable Finance Framework

Metrobank’s Framework is aligned with local and international market standards, including:

- ICMA Green Bond Principles (2025)

- ICMA Social Bond Principles (2025)

- ICMA Sustainability Bond Guidelines (2021)

- LMA/LSTA/APLMA Green and Social Loan Principles (2025)

- ASEAN Capital Markets Forum (ACMF) Green, Social, and Sustainability Bond Standards

- ASEAN Taxonomy for Sustainable Finance

- Philippine Sustainable Finance Taxonomy Guidelines

The Framework is applied consistently across financing and refinancing activities in accordance to these standards.

Eligible Categories

Under the Framework, net proceeds are allocated to eligible green and social project categories that deliver defined environmental and social benefits and support a broad range of United Nations Sustainable Development Goals (UN SDGs). These projects include activities related to renewable energy, clean transportation, energy efficiency, green buildings, pollution prevention and control, sustainable water and wastewater management, sustainable agriculture, access to essential services, food security, affordable housing, and microfinance and MSME empowerment.

These eligible use-of-proceeds categories reflect established sustainable finance practices and provide a mechanism for channeling capital toward activities with measurable sustainability outcomes. Separately, Metrobank’s broader sustainability strategy is guided by its priority SDGs: No Poverty (SDG 1), Zero Hunger (SDG 2), Quality Education (SDG 4), Decent Work and Economic Growth (SDG 8), and Industry, Innovation, and Infrastructure (SDG 9) – which inform the Bank’s overall approach to inclusive growth, economic development, and responsible banking.

Together, the Framework and the priority SDGs operate in a complementary manner, ensuring that sustainable finance initiatives, risk management protocols, and development priorities are aligned under a coherent sustainability agenda. The Framework allows for the inclusion of additional eligible categories, subject to internal governance, risk appetite, and alignment with applicable standards.

Project Evaluation, Management of Proceeds, and Reporting

The Framework sets out a process for project evaluation and selection. Eligible projects are reviewed and approved by relevant business and control units, including the Sustainability Department, and are monitored throughout the life of the financing. Net proceeds from sustainable finance instruments are tracked through dedicated internal systems.

Metrobank publishes annual allocation reports until full allocation, disclosing the allocation of proceeds by eligible category, the balance of unallocated proceeds, and the share of financing and refinancing. Where practicable, relevant environmental and social impact indicators are also disclosed.

Independent External Review and Second-Party Opinion

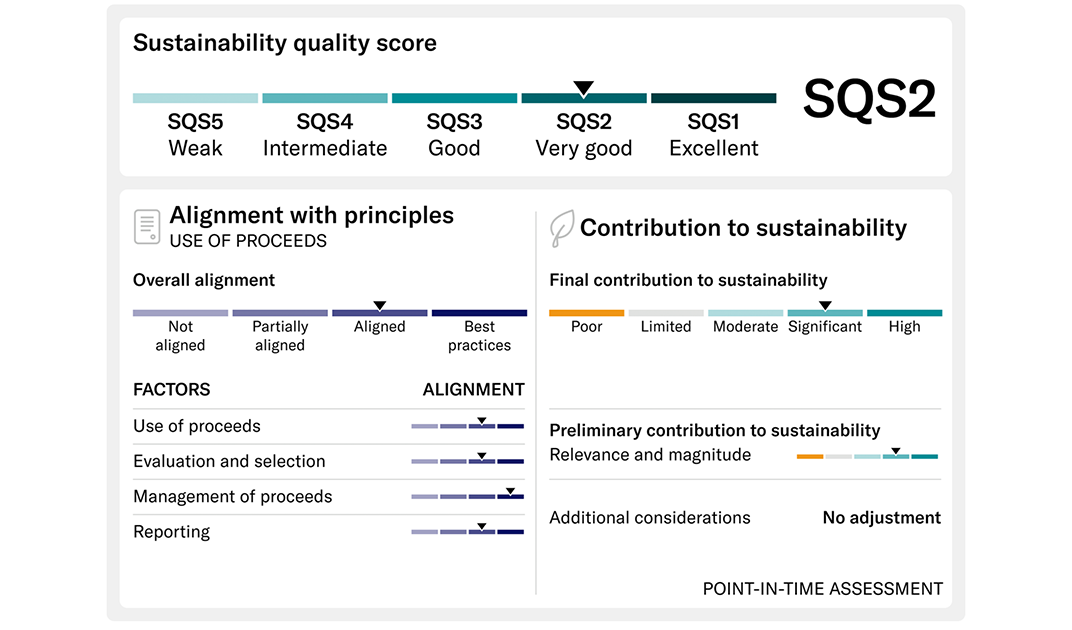

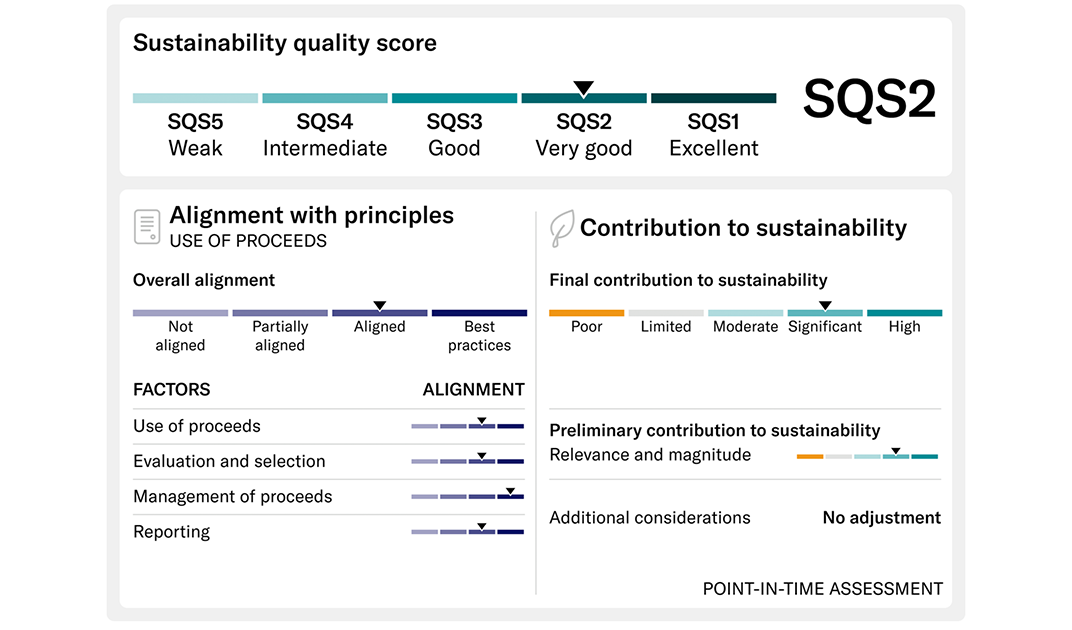

To reinforce transparency and market credibility, Metrobank obtained an independent Second-Party Opinion (SPO) from Moody’s Ratings on its Sustainable Finance Framework. Following the assessment, Moody’s assigned the Framework a SQS2 Sustainability Quality Score, indicating a “very good” contribution to sustainability and strong alignment with international principles. A SGS2 rating places the Framework among a select group assessed by Moody’s Ratings as demonstrating strong market alignment and sound contribution to sustainability.

Moody’s confirmed alignment with applicable ICMA and LMA/LSTA/APLMA principles and ASEAN standards, and highlighted the clarity of eligible categories, robustness of project evaluation and selection, strength of management of proceeds, and transparency of allocation reporting.

Access to Documents

The following documents are available for download:

• Metrobank Sustainable Finance Framework

• Moody’s Second-Party Opinion on the Sustainable Finance Framework

For more information, you may reach the Metrobank Sustainability Department through:

Metrobank Sustainability Department

Email: RSK.SD@metrobank.com.ph

Contact: (+63) 8859 6300 local 69001

Address: Metrobank Center, Bonifacio Global City, Taguig City, Philippines