After December 31, 2021 certain interest rate benchmarks will cease to be published, as part of the global transition away from LIBOR (London Inter-Bank Offered Rate) at the behest of international regulators. The following information is relevant if you use these interest rate benchmarks in financial products, loans, contracts or processes.

Why is LIBOR being discontinued?

Calculation of LIBOR was reformed after the Global Financial Crisis to make it less prone to manipulation. However, the decrease in underlying bank transactions in recent years still required expert judgment of the LIBOR panel banks, which may no longer be representative or reliable. The continued challenges initiated discussions and plans for LIBOR cessation and the use of alternative risk-free rates (RFRs).

What happens after December 31, 2021?

- LIBOR settings for EUR, GBP, CHF and JPY currencies across all tenors will cease.

- LIBOR settings for 1-week and 2-months will cease for USD. The rest of the tenors — overnight, 1-, 3-, 6- and 12-months will continue to be published until June 30, 2023, then cease altogether.

- Consequently, PHIREF (Philippine Interbank Reference Rate) which is the implied PHP rate derived from FX swap transactions using USD LIBOR, shall mostly align. The 1-week, 2- and 12-months will cease while the rest of the tenors — overnight, 1-, 3-, and 6-months shall continue to be published at 11:30AM daily (no more 4:30 and whole day PHIREF) until USD Libor ceases for these tenors on June 30, 2023.

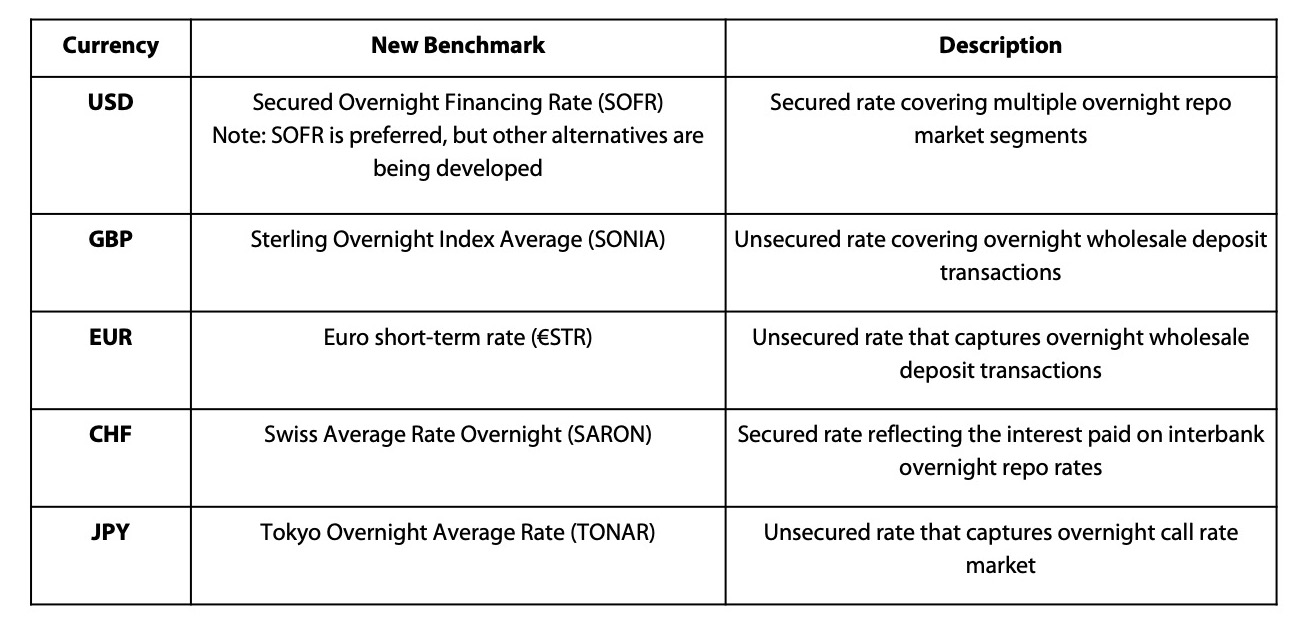

What benchmark rates will replace LIBOR and PHIREF?

Market participants and industry bodies, with the direction of regulators, have put significant efforts in identifying a set of alternative rates that are considered more robust and reliable than LIBOR. They are based on actual overnight transactions, as opposed to contributed quotations in the interbank market.

The successor for PHIREF has not been determined, and is currently being discussed by the Bankers’ Association of the Philippines and stakeholders. Upon the demise of PHIREF, Fallback Rates shall be calculated and published using USD SOFR for legacy contracts.

How is the Bank preparing for the transition?

The Bank recognizes that our clients will be affected by the transition through the products and services we offer. The Bank is actively involved in discussion and transition efforts with regulators, industry bodies and individual market participants, whilst continuing to stay close to the global developments on the transition. A key development would be the determination of the most acceptable term floating rates, given that the new benchmarks are overnight rates.

We will continue to provide information on developments relating to LIBOR as the transition evolves.

For more information, visit the following websites:

https://www.fca.org.uk/news/press-releases/announcements-end-libor

https://bap.org.ph/markets/#dr