News | Press Releases

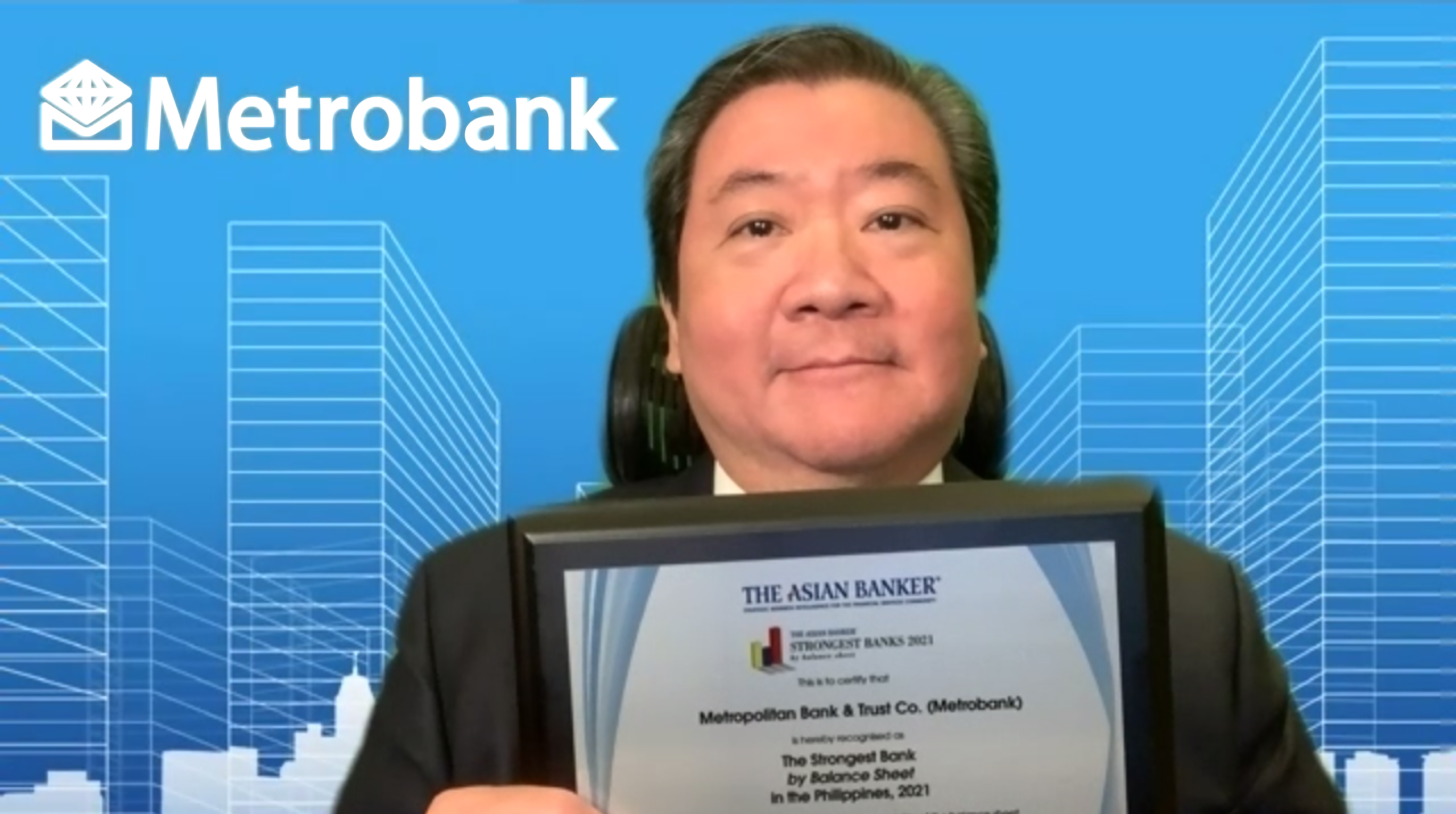

Metrobank hailed the Strongest Bank in the Philippines

The Asian Banker recently recognized the Metropolitan Bank & Trust Co. (Metrobank) as the Strongest Bank in the Philippines in 2021. The award is part of The Asian Banker’s pioneering and most credible annual ranking analysis of all major banks in the Asia Pacific Region based on their strongest balance sheet performance.

Metrobank President Fabian S. Dee attributes the award to the customers, “On behalf of all Metrobankers, especially those who are at the frontlines, ensuring that the flow of financial activity remains uninterrupted at the height of a global pandemic, we would like to thank our valued clients for their trust and confidence throughout our almost six decades of service. It is because of their continued support, that we have been ranked as the Strongest Bank in the Philippines by The Asian Banker.”

The Asian Banker Strongest Banks ranking is based on six key areas of balance sheet performance: scalability, balance sheet growth, risk profile, profitability, asset quality, and liquidity. While Metrobank performed well across these metrics, the Bank was recognized for its exceptional asset quality and liquidity amidst the pandemic as the key factors for its bolstered financial strength.

“Compared to its peers in the Philippines, the winning bank showed stronger performance in capitalization and liquidity. Its capital adequacy ratio improved further from 17.5% in 2019 to 20.2% in 2020, while its liquid assets to total deposits and borrowings ratio rose to 54.5% from 31.5%,” The Asian Banker affirmed. “In addition, its loan loss reserves to non-performing loans ratio was the highest among its peers in the country, and it also had the second lowest gross NPL ratio, at 2.4%”, the premier financial publication added.

“We are particularly proud of this recognition, as the assessment covered not only the quality of our balance sheet and our competitive profile but perhaps more importantly, we were recognized for our commitment of keeping our customers and our people in good hands,” Dee pointed out.

Metrobank was also recently recognized as the Best Domestic Bank in the Philippines at the Asiamoney Best Bank Awards 2021, citing the bank’s “sheer resilience during tough times” as its defining trait.

Dee stressed Metrobank’s emphasis on maintaining a “Fortress Balance Sheet”, which is structured to support the Bank’s business goals, maximize financial performance, and provide asset safety to its clients, regardless of any economic turbulence.

“We are strong and resilient because we are proactive,” Dee said. “We knew we had to be prudent and practical during these uncertain times, so we took steps to ensure strong capital levels and to keep a healthy balance sheet with best-in-class asset quality,” he concluded.

ABOUT METROBANK:

Metrobank is one of the strongest and well-capitalized banks in the country. The Bank believes that its robust capital position and balance sheet strength will provide ample support as it navigates through these uncertain times. Capital ratios are among the highest in the industry, with total CAR at 20.4% and Common Equity Tier 1 (CET1) ratio at 19.5%. Consolidated assets stood at P2.5 trillion at the end of June 2021, making Metrobank the country's second largest private universal bank.

More Smart Reads

Turning “someday” into “now” for your family’s next big purchase with Goals Made Real

Feb 20, 2026

Metrobank achieves another record income of PHP 49.7B in 2025

Feb 19, 2026

The Love Language of Money: How your shared financial habits can say ‘I Love You’

Feb 12, 2026