Corporate Governance

Sustaining Strong Corporate Governance

Good corporate governance is the foundation of trust and sustainable growth at Metrobank, guided by the principles of accountability, fairness, transparency, and ethical leadership.

With a strong compliance culture, robust risk management, and prudent oversight from a diverse Board of Directors, we ensure that all decisions are made in the best interest of our stakeholders. We remain steadfast in our promise to ensure that Filipinos are in good hands when they bank with us, with governance at the heart of everything we do.

Our commitment has been recognized with the prestigious 4-Golden Arrow distinction from the Institute of Corporate Directors, affirming our dedication to excellence in governance and long-term value creation.

Board of Directors

Our Board of Directors plays a vital role in shaping Metrobank’s long-term success by guiding strategic direction, overseeing key decisions, and ensuring alignment with our vision, mission, and stakeholder interests. The Board reviews and approves corporate strategy, governance, risk management, capital structure, senior leadership appointments, and sustainability initiatives, while fostering a culture of accountability and sound decision-making. With a diverse mix of skills, experience, and perspectives, supported by clear governance policies and a dedicated Corporate Secretary, the Board ensures effective oversight, guards against conflicts of interest, and remains responsive to the evolving needs of the Bank and its subsidiaries.

Board Composition and Diversity

In 2024, our commitment to board diversity remained a cornerstone of our success, with a well-rounded mix of directors bringing expertise in finance, technology, marketing, risk, sustainability, and other key areas, including female representation that enriches perspective and decision-making.

The Board, re-elected during the Bank’s Annual Stockholders’ Meeting, consists of 12 directors, 10 of whom are non-executive, and two executive directors. Five of the 10 are independent directors, with female representation, ensuring both diverse perspective and objectivity. With stable committee compositions and the continued guidance of our Board of Advisors, we maintained focused oversight, strategic continuity, and strong governance across all areas of the Bank.

Chairman of the Board and the President

Our Chairman, Mr. Arthur Ty, steers the Board’s overall leadership and direction while ensuring that the Board carries out its obligations to our Bank and to our stakeholders and encouraging collective dialogue for the Bank’s greater good.

Acting on the Board’s decisions and based on his sound judgment, our President, Mr. Fabian S. Dee, manages our Bank’s business and operations and articulates the vision and mission to the organization. He implements strategies, champions excellence, and promotes the Bank’s long-term interests.

Lead Independent Director

Since his appointment in August 2021, Lead Independent Director Philip G. Soliven has played a key role in fostering open dialogue, encouraging diverse perspectives, and promoting balanced, stakeholder-focused decision-making within the Board.

Term Limit and Policies on Directorships

Our Corporate Governance Manual outlines strict policies on term limits and interlocking directorships, in full compliance with BSP and SEC regulations.

In 2024, no director exceeded the prescribed limits, including the nine-year cap for independent directors, five board seats for non-executive directors, and two-board seats for executive directors in other publicly listed companies.

Board Meetings

Our Board of Directors conducts diligent and focused board meetings, that fosters strategic collaboration, risk mitigation, and value creation.

Conduct of meetings

Regular Board meetings are held every second Wednesday of the month, with special meetings convened as needed by the Chairman, Vice Chairman, or at the written request of at least four directors. Committee meetings follow their respective charters and approved schedules.

Meeting setting and materials

To ensure inclusivity and flexibility, our Board and committee meetings adopt a hybrid setup, allowing both in-person and virtual participation for meaningful engagement.

Directors joining remotely are fully integrated into discussions and decision-making processes. Meeting materials are made available on the intranet at least five banking days in advance, while directors maintain open communication with senior management and key advisors on strategic and operational matters.

Meeting quorum

Our directors act collectively as a Board, with no individual decision-making authority. A majority of directors is required to form a quorum and approve actions, and no agreements exist that compromise their independent voting rights, in line with corporate governance guidelines.

Non-Executive Directors meeting

Demonstrating proactive oversight, our non-executive directors, led by Lead Independent Director Mr. Philip G. Soliven, met on 23 October 2024 with the heads of Compliance, Audit, Risk, and SGV & Co. Discussions centered on industry trends, sustainability, risk management, internal audit strategies, and compliance with the AFASA law.

Corporate Secretary

Our Corporate Secretary, independent from the Board and the Chief Compliance Officer, advises directors on their duties and ensures timely access to relevant information before meetings. The role and responsibilities are defined in the Bank’s Amended By-laws and Corporate Governance Manual.

Board Nomination and Election Process

The Bank follows a transparent and thorough nomination and election process for selecting new directors. The Nomination Committee evaluates potential candidates based on their skills, experience, and independence to align with the Bank’s strategic goals.

Board Oversight/Committees

The Board of Directors utilizes a strong committee structure to oversee key areas, with seven committees chaired by Independent Directors (IDs) who bring relevant expertise. These committees, such as the Anti-Money Laundering, Audit, Risk Oversight, Trust, Executive, Nominations, Overseas Banking, Related Party Transactions, Corporate Governance and Compensation, and Information Technology Steering Committees, ensure comprehensive oversight in areas including audit functions, risk management, and corporate governance. The committees meet regularly, following their charters, to provide strategic guidance and ensure compliance with industry regulations and internal policies. Their duties and responsibilities are fully outlined in the Corporate Governance Manual and disclosed on the Bank’s website.

Policies on Performance Evaluation

In 2024, our Board of Directors conducted a thorough self-evaluation to assess its performance in areas such as strategic leadership, risk management, and financial oversight. The evaluation, led by the Corporate Governance and Compensation Committee (CGCCOM), included assessments of the Board, individual directors, the Chairman, President, and Board committees using a five-point rating system. The results, gathered through a combination of quantitative and qualitative data, highlighted strengths and areas for improvement, with a focus on ESG initiatives and leveraging technology. The findings were presented to the CGCCOM in March 2024 for further discussion and action.

Control Functions

In 2024, the Board, through the Audit Committee, CGCCOM, and Risk Oversight Committee, assessed the performance of the heads of Internal Audit, Compliance, and Risk Management. The evaluation confirmed that these key personnel effectively mitigate risks, ensure compliance, and safeguard the Bank’s assets, meeting performance expectations.

Employee

Employee performance is regularly evaluated through one-on-one meetings with supervisors, followed by leader-led reviews of evidence-based metrics.

In 2024, we continued to uphold our performance management framework to effectively monitor and enhance employee productivity.

Third party external facilitator

We engaged Reyes Tacandong & Co. (RT&Co.) to conduct an independent assessment of the Board's effectiveness and role execution, in line with SEC and BSP regulations. The assessment, building on the 2021 review, confirmed significant progress in corporate governance practices and compliance with regulatory requirements.

Policies on Onboarding and Continuing Education

The Bank has a robust orientation program, providing new directors with an eight-hour orientation, including key governance documents and meetings with senior executives to understand business challenges. This ensures they are fully equipped and accountable from day one. No new directors required orientation in 2024.

Continuing Education

Directors are required to undergo and complete annual training to stay informed about the Bank, industry trends, and key regulations. In 2024, a groupwide corporate governance training covered leadership, governance, data protection, AML updates, and ESG practices. An anti-money laundering training was also conducted in August 2024 to ensure compliance with regulatory obligations.

Employee Learning

In 2024, the Learning Development Department (LDD) expanded its portfolio to enhance employees' foundational, functional, and leadership capabilities. The foundational portfolio covers core values and regulatory policies, while the functional portfolio deepens role-specific expertise like Treasury certifications and Java programming. The leadership portfolio focuses on developing leadership qualities aligned with the Bank’s leadership behaviors.

Compensation Policy

Our compensation policies align with the Bank's strategic and financial goals, market conditions, and regulatory requirements, promoting performance and excellence.

The Board of Directors receive a fixed package based on experience, responsibilities, and attendance at meetings, while Executive Directors are compensated as full-time Executive Officers. In 2024, the Board received PHP70.76 million in total fees and compensation.

Executive officers and employees are compensated based on their roles, with regular reviews and adjustments based on performance and market benchmarks. Our compensation for non-officer employees follows labor laws and the Bank's Collective Bargaining Agreement.

Policies on Succession Planning and Retirement

The Board has implemented a succession plan to ensure top-caliber leaders by identifying and developing top talent for key positions. Board vacancies are filled through majority votes by directors or stockholders during regular or special meetings.

Senior management appointments are based on rigorous behavioral assessments and reviewed by the Manpower and Nominations Committees.

We actively prepare successors through talent reviews, cross-posting, and leadership development initiatives, while adhering to a retirement age of 75 for directors and 55 years or 30 years of service for employees.

Governance Policies and Standards

At Metrobank, we are committed to upholding the highest standards of corporate governance through robust policies and procedures that ensure transparency, accountability, and ethical conduct across all operations.

Our Corporate Governance Manual (CGM), which is annually reviewed and approved by the Board, guides the Bank’s governance framework. This includes managing compliance risks through a comprehensive Compliance Policy Manual, embedding a culture of adherence to legal and ethical standards across the organization, and continuously updating policies to align with industry best practices.

Our governance framework incorporates a Code of Conduct for both directors and employees, with regular training to reinforce ethical behavior, alongside policies on anti-bribery, anti-money laundering, and conflict of interest management.

We prioritize shareholder and customer interests through clear policies that ensure fair treatment, transparent disclosures, and rigorous oversight. This includes a focus on protecting stockholder rights, transparent dividend policies, and safeguarding customers’ data privacy and financial protection. Furthermore, our policies on supplier relationships, insider trading, and related-party transactions ensure fair dealings and compliance with legal requirements. Through these efforts, we maintain a strong commitment to ethical business practices, fostering long-term value creation for all stakeholders while maintaining trust and transparency.

Employees’ Health, Safety and Wellbeing

At Metrobank, employees’ health, safety, and overall wellbeing remain a top priority. Through the Metrobank CARES Program, we promote holistic wellness which includes physical, mental, emotional, social, spiritual, financial, and occupational initiatives. We provide resources, support, and initiatives that enhance productivity and employee experience. In 2024, we continued to engage employees through health assessments, wellness webinars, and on-site caravans. We also maintained a safe and compliant workplace aligned with labor laws and emergency preparedness protocols.

Risk Management

Managing Risk, Creating Value

At Metrobank, recognizing and managing risk is essential to achieving long-term business success and ensuring financial stability.

We operate in a dynamic environment influenced by geopolitical events, health crises, market fluctuations, and regulatory shifts. In response, we have continuously enhanced our risk management framework to safeguard our assets, meet regulatory standards, and uphold stakeholder trust.

Guided by key principles, we only take calculated risks that we fully understand, aligning decisions with our strategic goals. We treat risk management as a shared responsibility across the organization.

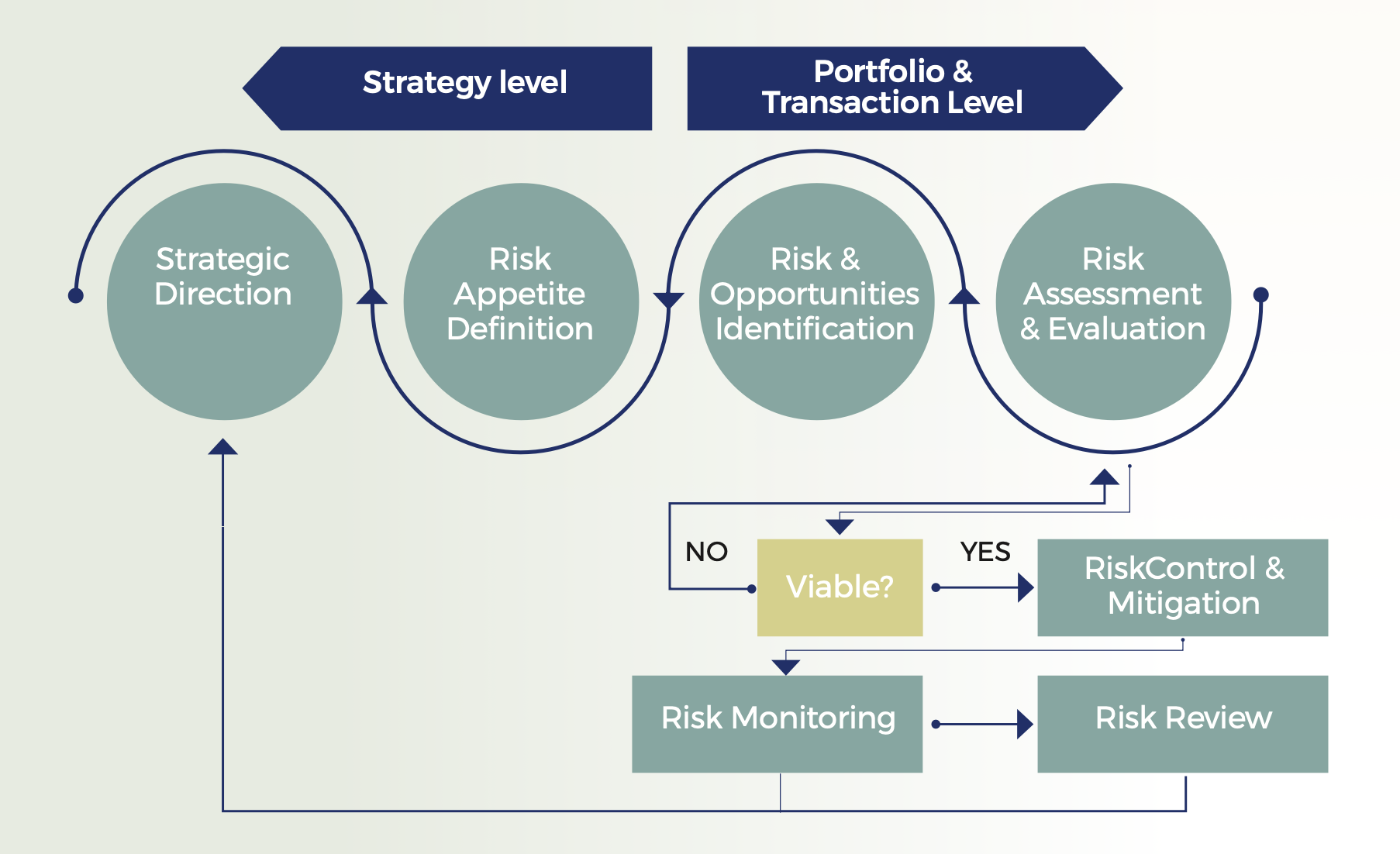

Our Risk Management Approach and Structure

Metrobank’s risk management approach balances business growth with prudent oversight, ensuring the Bank remains sound and resilient. We actively identify, assess, and monitor material risks, establish risk appetites, and implement mitigation strategies as needed. Using best-in-class tools and regulatory-compliant metrics, we take a proactive approach in addressing potential issues, enabling optimal capital allocation and sustainable value creation.

Our risk management structure is anchored on strong governance. Through the Risk Oversight Committee (ROC), the Board of Directors ensure a sound risk culture, and exposures remain within the Bank’s risk appetite. With dedicated divisions such as sustainability, credit risk, market and liquidity risk, enterprise and quantitative risk, RSK has oversight responsibility for the different risk exposures of the Metrobank Group and our subsidiaries.

Navigating Risks in our Operations

As a Domestic Systematically Important bank, we manage a wide range of risks across our operations, including strategic, credit, market, interest rate, technology, compliance and regulatory, reputational, contagion, liquidity, and environmental and social risks.

We maintain a disciplined approach to only taking risks aligned with our capacity and strategic growth goals, guided by a comprehensive risk framework and Board-approved policies. These safeguards the Bank’s commitment to financial resilience and long-term stakeholder value.

Maintaining Capital Adequacy

We maintain healthy capital ratios by complying with regulatory requirements and actively managing our consolidated capital structure in response to economic shifts and risk factors.

Our Capital Planning Process aligns strategic goals with financial forecasts and capital needs, ensuring adequacy through regular monitoring and early warning indicators. The Controllership Group generates actual capital ratios to the Risk Oversight Committee, while we fulfill BSP reporting requirements in line with regulatory standards.

Internal Audit

Our Internal Audit Group (IAG) provides independent, risk-based assurance and insights to the Board and senior management, strengthening the Bank’s governance, risk management, and internal control systems.

Operating under global standards such as Global Internal Audit Standards (GIAS) and guided by the Internal Control-Integrated Framework of the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and the Control Objectives for Information and Related Technology (COBIT), IAG oversees audit functions across subsidiaries and collaborates with other control units to identify and mitigate emerging risks and evaluate effectiveness of governance systems.

In 2024, IAG advanced its transformation by aligning audit priorities with strategic goals, strengthening proactive engagement with senior management, and amplifying risk awareness across the organization.

Audit Committee Report to the Board of Directors

As set forth in the Board-approved Committee Charter, the primary role and key responsibility of the Audit Committee is to assist the Board of Directors in fulfilling its statutory and fiduciary responsibilities, as well as protecting the value and interests of shareholders, through providing an effective oversight of the internal and external audit functions; and ensuring transparency and proper reporting, compliance with internal policies and regulations, and maintenance of adequate and effective internal control system that is designed to provide reasonable assurance in areas such as financial reporting, risk management, governance and operational execution, including safeguarding of physical and information assets.

The Audit Committee is composed of three qualified non-executive members duly appointed by the Board of Directors, with two of its members as independent directors including the Chairperson. All Committee members have relevant background and experiences, and possess appropriate knowledge and skills necessary in carrying out their functions. The directors also hold membership positions in other Board-level Committees of the Bank, through which they are apprised of developments in other areas and are able to provide advice on risk taking and management activities.

In 2024, the Audit Committee held a total of 12 regular meetings and one special meeting. Each committee meeting was attended by the Chief Audit Executive to present the strategic plans and focus areas, including any revisions or updates thereto; to report on the progress or results of audit activities, and highlight the significant issues arising from audit reviews and investigations, as well as the committed actions of the Management and impact of the implemented audit recommendations to the organization; to provide an overall assessment on the adequacy and effectiveness of the Bank’s governance, risk management and internal control; and to periodically attest to the independence and objectivity of auditors as well as the quality of the internal audit function. The Chief Risk Officer, Controller, and key Management Officers, and External Auditor attended relevant sessions and provided pertinent information.

The Audit Committee kept the Board of Directors regularly informed of the results of audit activities and recommendations. The Chairman of the Committee had duly performed the Committee’s main responsibility to apprise the Board of Directors as to the soundness of the Bank’s internal control and risk management system over financial reporting, compliance and operational matters, as well as audit-related activities, and reported the identified areas requiring actions and improvements. It also met with all other independent and non-executive Board members, together with the External Auditor, and the Heads of Internal Audit, Risk Management and Compliance Functions at a special meeting without the presence of any Senior Executives, and discussed the identified critical risk areas and the impact of emerging technologies and Environment, Social and Governance developments along with the Management action plans and commitments to appropriately address these risks, and the IA strategies and efforts to evaluate the solutions and controls put in place by the Management to monitor and mitigate exposures driven by the evolving risk landscape.

The Committee completed the regular work program for the year 2024 and effectively performed its core duties and oversight function on the following areas:

-

Financial Reporting and Disclosure: Performed effective oversight over the Bank’s financial reporting process/ system and disclosure controls. Evaluated adequacy and effectiveness of the Bank’s accounting policies; assessed proper implementation of financial management controls; ensured that the reporting process and disclosure requirements are in compliance with applicable accounting standards and regulations; and, recommended necessary improvements and determined appropriateness of corrective actions taken by the Management.

The Audit Committee reviewed and discussed with Management and the External Auditor the results of audit of the financial statements and related disclosures for the year ended December 31, 2024, and reported the same to the Board of Directors for approval.

-

Risk Management and Internal Controls: Evaluated the Bank’s risk management techniques and results thereof, and the internal control policies and procedures, systems, and processes through the audit assessment results derived from the focused testing on priority risk areas, particularly controls on fraud prevention, anti-money laundering and terrorist financing, information security/data privacy, cybersecurity, and business disruption. The Audit Committee continued the proactive engagement and involvement of Management in assessing adequacy of process control designs and effectiveness of implementation of control procedures, as well as in ensuring timely resolution of audit observations and recommendations, effectively conveying the culture of risk awareness and ownership within the organization.

-

Regulatory Compliance: Assessed the effectiveness of governance functions which provided oversight on the Bank’s compliance with legal and regulatory requirements, including establishment and monitoring of whistleblowing policy and processes, as promulgated by the Bangko Sentral ng Pilipinas and other regulatory government agencies.

The Audit Committee has performed the required review of its Charter to ensure that it is updated, aligned with peers, and compliant with regulatory changes and recommended best practice. The Committee also conducted an annual self- assessment to evaluate their performances against the requirements of the Charter.

-

Management and Internal Audit: Confirmed the effectiveness and quality of the internal audit function, including audit services and activities provided to Bank’s subsidiaries and associates. Among the oversight activities performed by the Committee for the internal audit function are the following: (i) reviewed and approved the risk assessment framework and the annual audit plan, including subsequent revisions and adjustments throughout the year; (ii) ensured adequacy of scope and activities, and monitored accomplishments and plan completion to provide basis for the overall audit conclusion; (iii) reviewed the Internal Audit charter and noted the enhancements in the audit policies and manual, and supervised its implementation; (iv) reviewed the audit reports received on a regular basis to assess the overall condition of the Bank’s internal control system; (v) discussed significant matters with Senior Management, as necessary, and evaluated timeliness of resolution of control weaknesses and compliance issues; (vi) recommended enhancements in the audit processes for continuous improvement; and, (vii) evaluated the performance of the Chief Audit Executive.

The Committee ensured that the internal audit function has maintained its independence throughout the year, has adequate expertise and competent resources, and has appropriate authority to effectively discharge its duties and achieve its goals and objectives to add value and deliver quality output to the organization. The Audit Committee continuously extends support and guidance to the Internal Audit Group as it navigates further through its journey towards the full implementation of the end-to-end process audit approach.

-

External Audit: Exercised effective oversight of external audit function as the Committee assessed and approved the reappointment of SyCip Gorres Velayo & Co. (SGV), as the Bank’s external auditor for 2024; ensured the external auditor's independence and objectivity for both assurance and non-assurance services rendered to the controlled entities of the Bank; discussed and agreed to the terms of the audit engagement, services, and fees; reviewed and approved all non-audit services and related fees to ensure that there is no conflict to independence; reviewed and approved the audit engagement plan, approach and scope of work; assessed the quality of work performed through the review of the results of audit and recommendations in the External Auditor’s Management Letter of Observations/Comments, and the action plans of Management on reported observations, including monitoring of disposition and status of corrective actions.

Based on the Committee’s accomplishments, representation from the Bank Management, External Auditor’s unqualified opinion on the financial statements, and the Chief Audit Executive’s overall satisfactory assessment on the adequacy and effectiveness of the Bank’s internal controls, risk management, and governance processes, the Audit Committee concludes that the business risks and emerging threats are effectively identified, measured and managed.

Edgar O. Chua, Chairman

Solomon S. Cua, Member

Angelica H. Lavares, Member