Switch now & get a free trip to Australia

Get up to 120K airmiles with Metrobank World Mastercard & no annual fees when you switch!

Promo Mechanics

Promo runs until February 29, 2024.

Apply now to avail this offer at apply.metrobank.com.ph/creditcard

Redeem your welcome gift through this link: https://metrobankcard.mymcc.gift

By going to this link, you will be redirected to the Giftaway page, which is an external website outside Metrobank site.

MASTERCARD

-

The Metrobank Switch 2023 Welcome Rewards Promo (the “Promo”) shall run from July 17, 2023 to January 31, 2024, extended until February 29, 2024 (“Promo Period”).

-

The Promo is open to newly approved and qualified principal Metrobank credit card cardholders (“Cardholders”) who:

a. Have applied and submitted complete application requirements within the Promo Period and were approved within 30 calendar days from the end of Promo Period for the following credit card types:

- Metrobank Toyota Mastercard

- Metrobank Platinum Mastercard

- Metrobank World Mastercard

b. Do not have an existing or cancelled Principal credit card issued by Metropolitan Bank & Trust Company (“Metrobank”) and have not had one in the last 6 months;

c. Must have an existing, active principal credit card and account in good standing with another bank at the time of application until approval; and

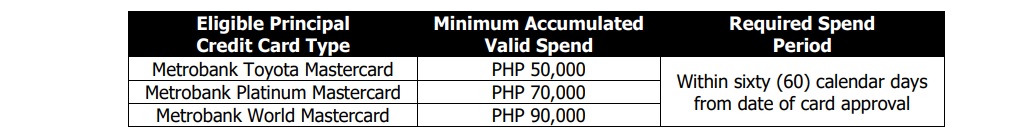

d. Must meet the required accumulated valid spend within 60 calendar days from date of card approval (“Spend Period”).

-

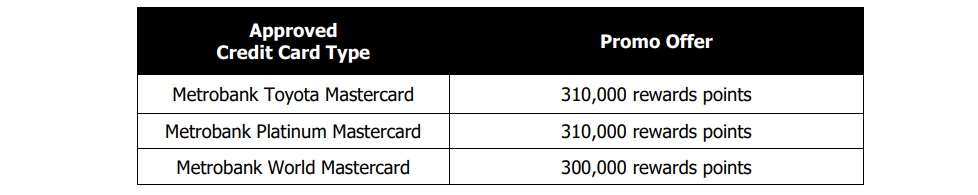

Qualified Cardholders will be awarded by Metrobank with a Welcome Reward upon meeting the required minimum accumulated Valid Spend on their new Metrobank credit card within the required Spend Period below:

-

Qualified Cardholders who meet the minimum accumulated valid spend requirement will receive the assigned welcome rewards awarded through rewards points. Redeemed rewards points can be converted to any item from the Metrobank Card Rewards Catalogue such as airmiles conversion, cash credit, or eGCs.

-

Welcome rewards Valid Spend includes only retail purchase and merchant installment transactions, inclusive of domestic, international, and online transactions. For merchant installment transactions, only the principal amount of transactions approved within the Spend Period will be counted as Valid Spend. Supplementary account/s’ Valid Spend will be counted as part of the principal cardholder’s spend.

-

The following transactions and fees will not be considered as welcome rewards valid spend: card fees, annual fees, cash advance and cash advance fees, balance transfer and balance transfer charges, loans and loan charges, cash2go and cash2go charges, balance conversion and balance conversion charges, interest charges, late payment charges, Bills2Pay, PayNow and other miscellaneous fees and recurring payments.

-

Qualified Cardholders who reach the accumulated valid spend on their newly approved credit card will receive an SMS with confirmation of his/her eligibility to receive the Welcome Reward.

-

To redeem the Welcome Reward, the cardholder must do the following:

a. Go to the promo redemption link in the Metrobank website (www.metrobank.com.ph) and search the promo name:

i. Scroll down to Featured Promotions. Select View More then search “Switch 2023” and click the link under the Promo Mechanics, “what are the mechanics?”; OR

ii. Use the search field in the main page of Metrobank website, enter “Switch 2023” and click search. Under the Promo Mechanics click, “what are the mechanics?”; OR

iii. Visit Giftaway’s redemption page at https://metrobankcard.mymcc.gift/

b. From the redemption page, qualified cardholder should provide his/her Metrobank-registered mobile number and agree that such information will be subject to the Confidentiality, Data Privacy and Security Policy/Terms of the e-gift provider, Giftaway Inc., and is subject further to the Data Privacy Act of 2012 (R.A. 10173). The redemption page will never ask for the card number, expiry date, or CVV.

c. Click on redeem to claim the Welcome Reward.

d. Welcome Reward will be credited to the qualified cardholder’s credit card account after 30 calendar days from cardholder’s clicking of the redeem button;

e. For reward points converted to airmiles, the cardholder shall be responsible in coordinating the conversion of airmiles to airline tickets with their preferred airline company. Reward points converted to airmiles does not include travel fees or accommodation to the preferred destination of the cardholder. To convert the points to reward items, cardholder may redeem these by calling Metrobank’s customer service hotline at (02)88-700-700.

f. Cap for airmiles and cashback card rebate redemption will be waived for qualified customers for this promo until December 31, 2024. Redemptions made after December 31, 2024 will be subject to the prevailing redemption cap.

g. Qualified cardholder entitled for the Promo may redeem the reward points and convert to airmiles based on the required amount of airmiles of their preferred airline. Free trip advertisements such as Boracay, Siargao, Japan, Hong Kong, Korea, Singapore, Sydney, etc. were computed based on PAL Mabuhay Airline table of airmiles conversion as of May 15, 2023. Metrobank does not have jurisdiction over changes in airline conversion to actual tickets.

h. Cardholder must redeem the Welcome Reward within sixty (60) calendar days from receipt of the SMS confirming the award of rewards points (“Redemption Period”). After which, the unredeemed Welcome Reward will be forfeited. In addition, the Welcome Reward cannot be exchanged for cash, other products or discounts. Redeemed Welcome Rewards are valid until fully consumed.

-

Should there be any change/s in the cardholder’s Metrobank-registered mobile number, it is the responsibility of the cardholder to update his/her contact information by calling the Metrobank Customer Service Hotline at (02)88-700-700.

-

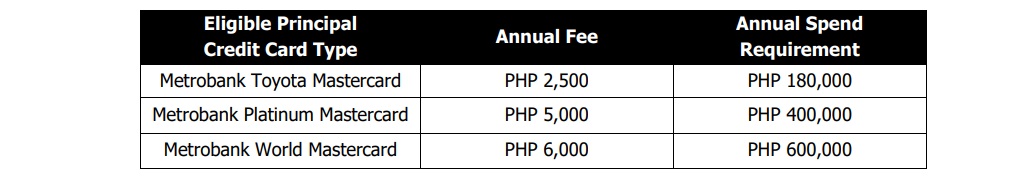

Principal cardholders who applied and get approved within the Promo Period are also eligible for the Switch 2023 Spend-Based Annual Fee Waiver promo, if they are able to meet the annual spend requirement using their newly-issued Metrobank credit card.

Annual spend requirement to qualify for the annual fee recurring waiver:

To illustrate:

a.1 A Principal cardholder’s card application was approved on July 17, 2023 (“Anniversary Date”). If he/she meets the annual spend requirement based on his/her approved card type, then he/she will be qualified for the Switch 2023 Spend-Based Annual Fee Waiver promo and does not need to pay the annual fee on his/her next annual spend requirement cycle on July 17, 2024.

a.2 A Principal cardholder’s card application was approved on January 1, 2024 (“Anniversary Date”). If cardholder meets the required annual spend based on his/her approved card type, then annual spend-based fee waiver will be applied on the next cycle date on January 1, 2025.

b. The posting date of the transactions will be the basis of qualification on the period allocated for the annual spend requirement each year.

c. If the principal cardholder does not meet the required annual spend, he/she will be charged an annual fee, which will be reflected on the principal cardholder’s statement of account.

d. Only the Principal cardholder can qualify for the Spend Based Annual Fee Waiver promo. Annual fee of supplementary cardholder will not be waived even if Principal cardholder meets annual spend.

e. The annual fee waiver is non-transferrable, and cannot be converted or exchanged for cash, credit, benefit, advantage, or any property.

f. The computation of the annual spend and awarding of the annual fee waiver to the principal cardholder by Metrobank is considered final.

g. Valid annual spend shall only include all straight retail transactions, online transactions, Bills2Pay, and Cash Advance. For retail installments and special installments such as Balance Transfer and Cash2Go, only amortized principal amount posted within 12 months from card issuance, will be considered as valid annual spend. Add-on interest is not included. Transactions made by supplementary cardholder will be included in the computation of principal cardholder’s annual spend.

h. Fees and charges, Balance Conversion installments, PayNow, credit adjustments resulting from merchant initiated credit adjustment and transaction disputes are not included in the computation of valid annual spend requirement.

i. Qualified Cardholders who reach the accumulated valid annual spend will receive a notification via SMS, with confirmation that required annual spend has been reached and will take effect in the account.

-

Metrobank will no longer accommodate cardholder requests for re-sending of SMS due to, but not limited to, the following reasons:

a. SMS sent successfully to the principal Cardholder but was accidentally or purposely deleted by the cardholder, members of their family or friends or due to upgrade or reformatting done to the cardholder’s mobile device; or

b. Lost, stolen, or defective mobile device; or

c. SMS sent successfully to the principal Cardholder’s mobile number maintained in Metrobank’s database during the Promo and Redemption Period but Cardholder failed to notify Metrobank of the change in his or her mobile number. Cardholders may contact Metrobank’s Customer Service Hotline at (02)88-700-700 to request for validation of the SMS and redemption link that were redeemed already but was deleted or lost.

-

Metrobank reserves the right to disqualify a previously approved transaction that was cancelled or charged back within the Promo period. Should the Cardholder receive the incentive but was later on deemed unqualified for not meeting the requirements of the incentives due to disputes arising from, but not limited to, erroneous, invalid, fraudulent or unauthorized transactions, the cost of the incentive shall be charged by Metrobank to the Cardholder’s credit card account.

-

Converted, upgraded, or change in the card type approved will disqualify the cardholder from receiving the Welcome Reward.

-

In the event that Principal Cardholder requests for an upgrade or conversion of the qualified card in the future, spend based annual fee waiver will no longer apply. The annual fee waiver cannot be transferred to the newly upgraded or converted credit card.

-

With the exception of Switch 2023 Spend Based Fee Waiver, a cardholder may only qualify for one acquisition promo at any given time. If a Cardholder qualifies for two (2) or more Cards under different acquisition promotions within the same promo period, they will be entitled to only one Welcome Reward. If a Cardholder qualifies under another acquisition promo during the same promo period, they will no longer be able to participate in this Promo. In this scenario, the reward will be based on which promo Cardholder was able to qualify for first based on Metrobank’s determination

-

In case of dispute on Cardholder’s eligibility, Metrobank’s decision shall prevail. All questions or disputes regarding the Cardholder’s eligibility for the Promo or for any redemption shall be resolved by Metrobank at its discretion.

-

Any dispute concerning the products or services related to the Promo offer shall be settled directly between the cardholder and the appropriate merchant, with the concurrence of the DTI.

-

In the event that the principal Cardholder cancels his/her Metrobank credit card within eighteen (18) months from the card opening date, Metrobank reserves the right to charge the equivalent pro-rated amount of Welcome Reward awarded to the cardholder.

-

All credit card applications shall be subject to Metrobank’s final approval and credit card terms and conditions.

-

Any dispute related to cardholder’s availment of any promo shall not be a valid reason for non-payment of cardholder’s credit card bill or outstanding balance. Hence, all accrued charges on the credit card while the dispute is ongoing shall be for the account of the cardholder.

-

The terms and conditions governing the issuance of Metrobank credit cards, reminders and other provisions contained in the card carrier, statement of account, charge slips and other documents or instruments, which are made an integral part hereof by reference, shall likewise be resorted to in instances where they are applicable in this Promo.

-

The use of the Metrobank credit card in connection with this Promo is subject to the Terms and Conditions governing the issuance and use of Metrobank credit card.

-

By joining or availing of this promo, the cardholder confirms that he/she has read, understood and agreed to the promo mechanics and its terms and conditions.

-

For any questions or clarifications, please contact Metrobank at (02)88-700-700.

-

Metrobank is regulated by the Bangko Sentral ng Pilipinas (BSP). Cardholders may likewise refer their concerns or comments to the Bangko Sentral ng Pilipinas (BSP) at 8811-1277 or send an email to consumeraffairs@bsp.gov.ph.

Terms & Conditions

Standard Terms and Conditions apply.

DTI Fair Trade Permit No. FTEB-172052, Series of 2023.